February 16, 2024

RICHMOND— Virginia Works (the Virginia Department of Workforce Development and Advancement) announced today that the U.S. Bureau of Labor Statistics’ December 2023 Job Openings and Labor Turnover Survey (JOLTS) reports moderating hiring and job quitting in the Commonwealth.

According to the most recent BLS JOLTS survey data, the number of December 2023 hires in Virginia decreased by 7,000 over the month and fell by 23,000, or thirteen percent, over the year. BLS JOLTS data provides information on all the pieces that go into the net change in the number of jobs. These components include job openings, hires, layoffs, voluntary quits, and other job separations (which includes retirements and worker deaths). Putting those components together reveals the overall change in payroll employment. JOLTS data is seasonally adjusted and describes conditions on the last business day of the month. Current month’s data are preliminary and the previous month’s data have been revised.

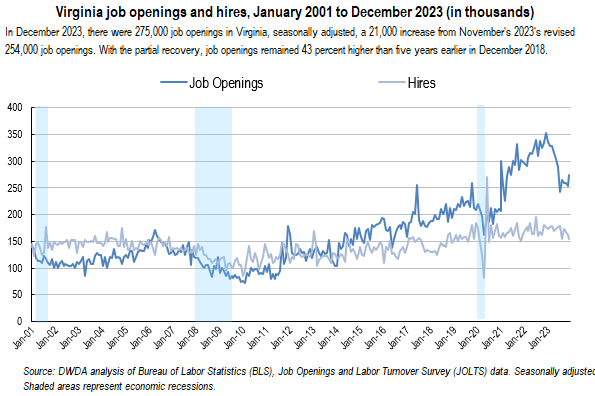

On the last business day in December, there were 275,000 job openings in Virginia, seasonally adjusted, a 21,000 increase from November 2023’s revised 254,000 job openings. Nationwide, the number of job openings changed little at nine million; this measure is down from a series high of 12.0 million in March 2022. Job openings significantly increased in professional and business services (+239,000) but decreased in wholesale trade (-83,000). The largest decreases in the job openings level occurred in Illinois (-42,000), Arizona (-21,000), and Wisconsin (-20,000). The largest increases occurred in California (+79,000), Michigan (+63,000), and Louisiana (+15,000).

In Virginia, the December job openings rate was 6.2%, up 0.5 points from November. The U.S. job openings rate was unchanged at 5.4 percent in December 2023. The U.S. rate was unchanged at 5.4%. The job openings rate significantly increased for establishments with 5,000 or more employees. Among the size classes, job openings rates ranged from 4.8 percent for establishments with 10 to 49 employees to 7.7 percent for those with 1 to 9 employees. Significant decreases in job openings rates occurred in Maine (-1.1 percentage points) and North Dakota (-0.8 point), as well as in Illinois and Wisconsin (-0.6 point each). The increases occurred in Michigan (+1.2 points), Louisiana (+0.7 point), and California (+0.4 point).

The number of hires in Virginia edged down to 154,000 in December, a decrease of 7,000 over the month and by 23,000 from December 2022. JOLTS defines hires as all additions to the payroll during the month. The number of hires was 43 percent lower than the series high of 271,000 set in June 2020. Nationwide in December, the number of hires was little changed at 5.6 million. The number of hires significantly decreased in health care and social assistance (-119,000) but increased in state and local government, excluding education (+35,000). The largest increases in the hires level occurred in California (+81,000), Arizona (+20,000), and Nevada (+15,000). The decrease occurred in Georgia (-36,000). In Virginia, the 3.7 hires rate was little changed from November’s revised 3.9 percent rate. In December, the U.S. was little changed at 3.6 percent. Significant increases in the hires rate occurred in Nevada (+0.9 percentage point) and in California (+0.5 point). The decrease occurred in Georgia (-0.7 point). The Virginia hires-per-job-openings (HPJO) ratio edged lower in December to 56 percent. For the last twelve months, the rate has hovered between five and six hires for every ten job openings in the Commonwealth. Nationwide, it has hovered around two hires for every opening over the past year. This measure shows the rate of hiring compared to open jobs and is a proxy for time to fill positions.

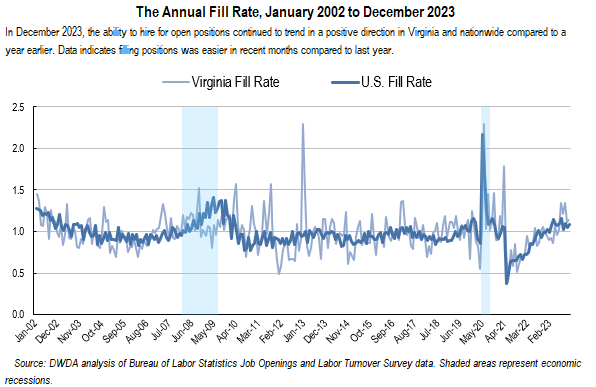

In December 2023, the Virginia ‘annual fill’ rate (the ratio of ‘this month’ hires to ’last month’ job openings, over the year) remained significantly above the historical, typical level of 1.0 at 1.14. The fill rate is a measure used to evaluate how labor markets differ in the pace that job openings are filled. An annual fill rate near or above 1.0 can indicate that employers are growing more efficient at filling job openings. On the other hand, an annual fill rate of less than 1.0 can indicate a tighter labor market, with employers having greater difficulty filling job openings compared to a year earlier. Going back to 2001, the highest annual fill rate occurred during June 2020 because, after the nationwide shutdown due to the COVID-19 pandemic, employers across the country sought to quickly hire for vacated positions. The lowest fill rate in Virginia occurred in June 2021. During that time, there were many factors that hindered the filling of vacant positions by employers, such as health concerns, employee skills, and childcare needs, but the biggest factor was the comparison against the historic re-hiring hike the year before.

On the last business day of December, the number of total separations in Virginia increased by 9,000 to 150,000. Nationwide, the number of total separations in December changed little at 5.4 million. Over the month, the number of total separations decreased in health care and social assistance (-91,000) but increased in wholesale trade (+39,000). The largest decreases in the total separations level occurred in Michigan (-50,000), Pennsylvania (-28,000), and Colorado (-20,000). The increases occurred in Maryland (+23,000) and South Carolina (+18,000). The Virginia total separations rate increased from 3.4 to 3.6 percent. The U.S. total separations rate was unchanged at 3.4 percent. The largest decreases in total separations rates occurred in Michigan (-1.1 percentage points), and in Oregon and South Dakota (-0.9 point each). The increases occurred in Maryland (+0.9 point) and South Carolina (+0.8 point).

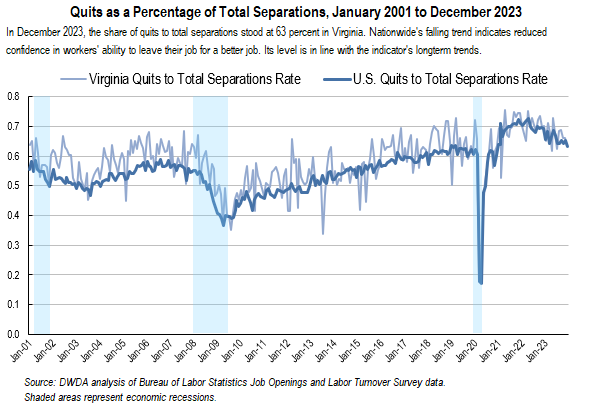

An estimated 95,000 workers quit jobs from Virginia employers in December. The number of quits decreased by 2,000 from November’s revised figure of 93,000. That was a twelve percent decrease over-the-year but a 16 percent increase from five years earlier. Quits, a component of total separations, are voluntary separations initiated by the employee. Nationwide, the number of quits changed little at 3.4 million. The number of quits decreased in health care and social assistance (-71,000) and in transportation, warehousing, and utilities (-35,000). The number of quits increased in wholesale trade (+63,000). The largest decreases in the quits level occurred in Michigan (-41,000) and Arizona (-17,000), as well as in Indiana and Oregon (-16,000 each). The quits rate in the Commonwealth edged up to 2.3 percent and remained at levels seen over the last two years. Over the month, the U.S. rate was little changed at 2.2 percent. The largest decreases in quits rates occurred in Michigan (-1.0 percentage point), South Dakota (-0.9 point), and Oregon (-0.8 point). The increase occurred in Georgia (+0.6 point).

The number of layoffs and discharges in Virginia rose to 47,000 in December. This was an increase of over a third over the year, but still typical of levels seen over the last twenty years. Layoffs and discharges are countercyclical, which means that layoffs typically increase during economic contractions and decrease during economic expansions. In December, the number of U.S. layoffs and discharges the number of layoffs and discharges changed little at 1.6 million. The number of layoffs and discharges increased in transportation, warehousing, and utilities (+43,000) and in state and local government, excluding education (+18,000). The largest increases occurred in Illinois (+21,000), Maryland (+20,000), and Indiana (+12,000). The Virginia layoffs and discharges rate rose to 1.1 percent, while the U.S. rate was unchanged at one percent for the fourth month in a row. Significant increases occurred in Maryland (+0.7 percentage point), Indiana (+0.4 point), and Illinois (+0.3 point).

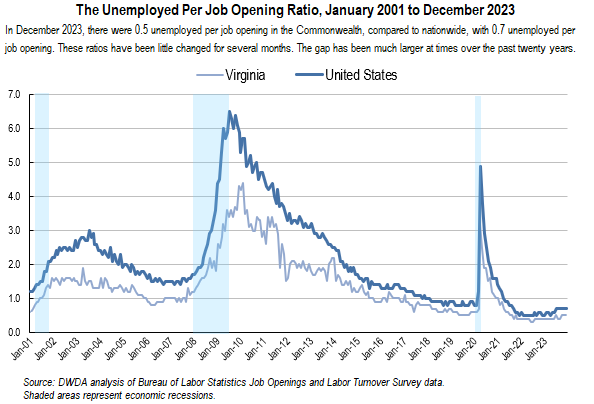

In December 2023, there was one unemployed worker for every two job openings in the Commonwealth, within the range that it has hovered since 2021. This period marked the lowest rates since January 2001, when BLS began collecting the data.

On the last business day of 2023, Virginia’s labor market exhibited traits largely present throughout last year. JOLTS data indicated its balance, with gradually increasing labor supply yet continued strong need among employers to fill open positions. Employers continued making headway toward staffing stability, with less quitting and greater hiring success. With this progress, the number of job openings have trended downward, yet remained more elevated than before the pandemic. The rate of job separations due to layoffs remained below pre-pandemic trends. Adding these things together shows that, at the beginning of the new year, Virginia’s labor market remained strong but not overheated.

Definitions of JOLTS terms*

Job Openings

Job openings include all positions that are open on the last business day of the reference month. A job is open only if it meets the following three conditions: (1) A specific position exists and there is work available for that position; the position can be full time or part time, and it can be permanent, short term, or seasonal; (2) the job could start within 30 days, whether or not the employer can find a suitable candidate during that time; and (3) the employer is actively recruiting workers from outside the establishment to fill the position. Excluded are positions open only to internal transfers, promotions or demotions, or recalls from layoffs.

Hires

Hires include all additions to the payroll during the entire reference month, including newly hired and rehired employees; full-time and part-time employees; permanent, short-term, and seasonal employees; employees who were recalled to a job at the location following a layoff (formal suspension from pay status) lasting more than 7 days; on-call or intermittent employees who returned to work after having been formally separated; workers who were hired and separated during the month; and transfers from other locations. Excluded are transfers or promotions within the reporting location, employees returning from a strike, and employees of temporary help agencies, employee leasing companies, outside contractors, or consultants.

Separations

Separations include all separations from the payroll during the entire reference month and are reported by type of separation: quits, layoffs and discharges, and other separations. Quits include employees who left voluntarily, except for retirements or transfers to other locations. Layoffs and discharges include involuntary separations initiated by the employer, including layoffs with no intent to rehire; layoffs (formal suspensions from pay status) lasting or expected to last more than 7 days; discharges resulting from mergers, downsizing, or closings; firings or other discharges for cause; terminations of permanent or short-term employees; and terminations of seasonal employees (whether or not they are expected to return the next season). Other separations include retirements, transfers to other locations, separations due to employee disability, and deaths. Excluded are transfers within the same location, employees on strike, and employees of temporary help agencies, employee leasing companies, outside contractors, or consultants.

*Excerpted from U.S. Bureau of Labor Statistics, Handbook of Methods, Job Openings and Labor Turnover Survey: Concepts, https://www.bls.gov/opub/hom/jlt/concepts.htm.

The Department of Workforce Development and Advancement (DWDA) plans to release the January 2024 analysis of the BLS Job Openings and Labor Turnover Survey for Virginia on Friday, March 22, 2024. The data for all states and the U.S. will be available on the BLS website JOLTS page, at https://www.bls.gov/jlt/. BLS is scheduled to release the January JOLTS data for states on Wednesday, March 19, 2024.

Technical note: The Bureau of Labor Statistics (BLS) Job Openings and Labor Turnover Survey (JOLTS) produces monthly data on U.S. and regional job openings, hires, quits, layoffs and discharges, and other separations from a sample of approximately 21,000 establishments. As a supplement, BLS has begun publishing state estimates that provide monthly information that can be used to better understand the dynamic activity of businesses in state economies that leads to aggregate employment changes. For more information on the program’s concepts and methodology, see “Job Openings and Labor Turnover Survey: Handbook of Methods” (Washington, DC: U.S. Bureau of Labor Statistics, July 13, 2020), https://www.bls.gov/opub/hom/jlt/home.htm. For more information on BLS’ state JOLTS estimates, see https://www.bls.gov/jlt/jlt_statedata.htm.

PDF of Press Release

PDF of Press Release