September 20, 2022

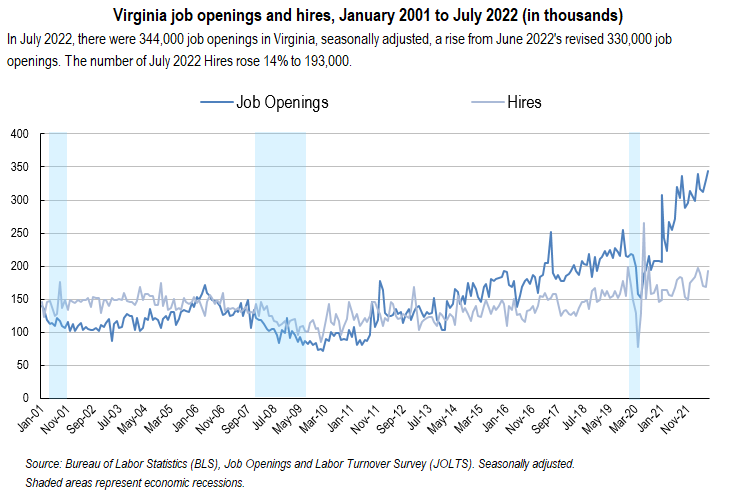

RICHMOND— The Virginia Employment Commission announced today the U.S. Bureau of Labor Statistics’ July 2022 Job Openings and Labor Turnover Survey (JOLTS) reports Virginia job openings rose to a record-high 344,000. With hires increasing by 24,000 in July, Virginia had the largest increase in workers in the nation.

According to the most recent BLS JOLTS survey data, the estimated number of July hires nationwide was little changed in most states and only significantly increased in Virginia. BLS JOLTS data provides information on all pieces that go into the net change in the number of jobs. These components include job openings, hires, layoffs, voluntary quits, and other job separations (which includes retirements and worker deaths). Putting those components together reveals the overall change in payroll employment. JOLTS data is seasonally adjusted and describes conditions on the last business day of the month. Current month’s data are preliminary and the prior month’s data have been revised.

The number of July 2022 job openings in Virginia was 344,000 and was a 14,000 increase from June’s 2022’s revised figure, exceeding the record 340,000 reached in March of this year. The U.S. number of job openings was little changed at 11.2 million on the last business day of July 2022. The number of job openings increased in transportation, warehousing, and utilities (+81,000); arts, entertainment, and recreation (+53,000); federal government (+47,000); and state and local government education (+42,000). Job openings decreased in durable goods manufacturing (-47,000). The Virginia job openings rate (job openings as a percentage of total employment) matched March’s 7.8% but was slightly lower than the series high of 7.9% set in September 2021. In July, the U.S. job openings rate was little changed at 6.8%

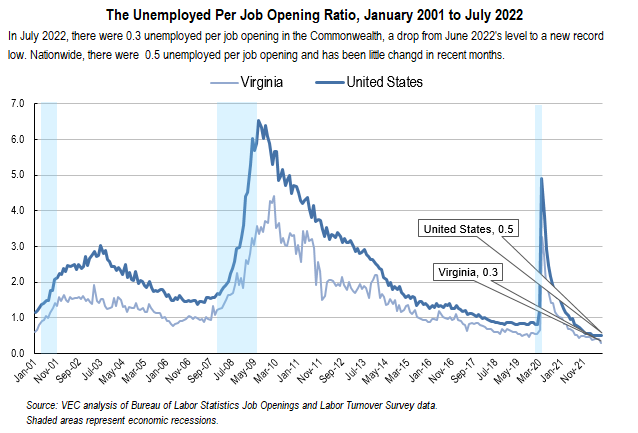

In July 2022, there was less than one (0.3) unemployed worker per job opening in the Commonwealth, after holding steady over the previous few months. July’s number marked the lowest rate since January 2001, when BLS began collecting the data. In Virginia, the unemployed per job opening ratio (sometimes called the ‘job seekers ratio’) peaked at 4.4 unemployed per job opening in February 2010 during the Great Recession, while the number of unemployed workers per job opening stood at 3.3 in April 2020 during the height of pandemic employment impacts.

In January 2020 (before the start of the most recent recession, which spanned February to April 2020), the U.S. job openings rate was 4.5% and had been above 4.0% for over 30 consecutive months. The unemployment rate had been 4.1% or lower for all of 2018 and 2019. It was 3.5% in January 2020. In April 2020, the job openings rate fell to its recent minimum, 3.5%, while the unemployment rate reached its recent peak, 14.7%. Since May 2020, there has been a steady increase in the job openings rate and decrease in the unemployment rate.

The number of hires in Virginia rose by 24,000 to 193,000 in July, which was nearly 8% greater over the year and a third higher than five years earlier. JOLTS defines hires as all additions to the payroll during the month. The series low of 77,000 was set in April 2020, while the high of 265,000 was set in June of that year. Nationwide, the number and rate of hires were little changed at 6.4 million and 4.2%, respectively. Hires were little changed in all industries. The hires rate significantly increased in establishments with 1,000 to 4,999 employees. In Virginia, the hires rate rose to 4.7% from June’s revised 4.2% rate. Across the nation in July, hires rates decreased in 4 states, increased in 1 state, and were little changed in 45 states and the District of Columbia.

An estimated 122,000 workers quit jobs from Virginia employers in July. The number of quits rose by 11,000 from June’s revised figure of 111,000 and was a quarter higher than a year earlier. However, it was down significantly from the record-breaking month of December 2021 when 131,000 Virginia workers quit their jobs. Quits, a component of total separations, are voluntary separations initiated by the employee. Across the U.S. in July, the number of quits was little changed at 4.2 million. Quits decreased in health care and social assistance (-73,000) and in state and local government education (-21,000). Quits increased in transportation, warehousing, and utilities (+39,000). The number of quits can be seen as a leading indicator of wage trends in that it includes workers who quit to move to another job.

The quits rate in the Commonwealth increased by 0.3 of a percentage point to 3.0% and remained at the highly elevated levels seen over the last twelve months. The quits rate nationwide was little changed at 2.7%. In July, quits rates decreased in 7 states and increased in 5 states. The largest decreases in quits rates occurred in Oklahoma (-0.9 percentage point), Georgia (-0.8 point), and Delaware (-0.7 point). The increases in quits rates occurred in Alaska and Vermont (+0.6 percentage point each), as well as Massachusetts, New Hampshire, and Pennsylvania (+0.5 point each).

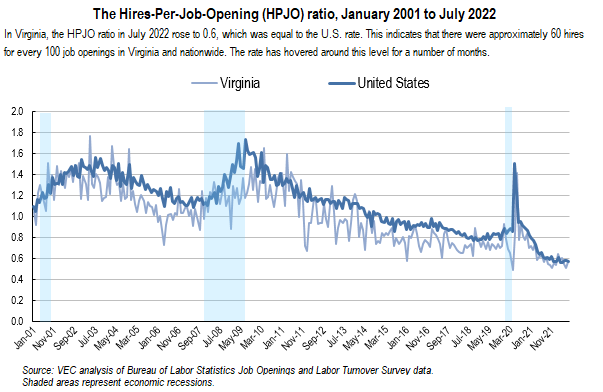

The hires-per-job-openings (HPJO) ratio was little-changed in July at around one hire for every two job openings in Virginia, equal to the 0.6 rate nationwide. This measure shows the rate of hiring compared to open jobs and is a proxy for time to fill positions. Over five years, the ability to hire for job openings has fallen by nearly a third nationwide and in the Commonwealth.

In July, the number of total separations in Virginia increased by 15,000 to 167,000 from June’s revised 152,000 estimate. The number and rate of total separations nationwide were little changed at 5.9 million and 3.9%, respectively in July. Total separations increased in transportation, warehousing, and utilities (+65,000). The Virginia total separations rate increased to 4.1%, compared to the 3.9% rate nationwide. In July, the national total separations rate was little changed over the month. Total separations rates decreased in 6 states, increased in 2 states, and were little changed in 42 states and the District of Columbia. The largest decreases in total separations rates occurred in Georgia (-0.9 percentage point) and in Massachusetts and Oklahoma (-0.7 point each). Increases occurred in Pennsylvania (+0.7 percentage point) and Minnesota (+0.6 point).

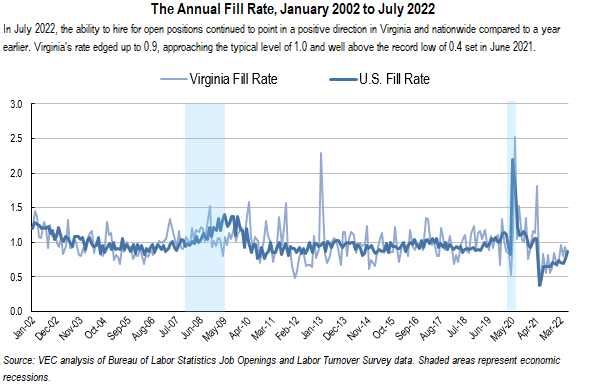

In July 2022, the ‘annual fill’ rate (the ratio of ‘this month’ hires to ’last month’ job openings, over the year) rebounded to 0.9 from the revised June’s figure of 0.8. The U.S. annual fill rate was little changed at 0.9. This indicates, in Virginia, a trend in recent month towards less difficulty in filling positions when compared to a year earlier. The fill rate is a measure used to evaluate how labor markets differ in the pace that job openings are filled. An annual fill rate near or above 1.0 can indicate that employers are growing more efficient at filling job openings. On the other hand, an annual fill rate of less than 1.0 can indicate a tighter labor market, with employers having greater difficulty filling job openings compared to a year earlier.

Going back to 2001, the highest annual fill rate occurred during June 2020 because, after the nationwide shutdown due to the COVID-19 pandemic, employers across the country sought to quickly hire for vacated positions. The lowest fill rate in Virginia occurred in June 2021. During that time, there were many factors that hindered the filling of vacant positions by employers, such as health concerns, employee skills, and childcare needs, but the biggest factor was the comparison against the historic re-hiring hike the year before.

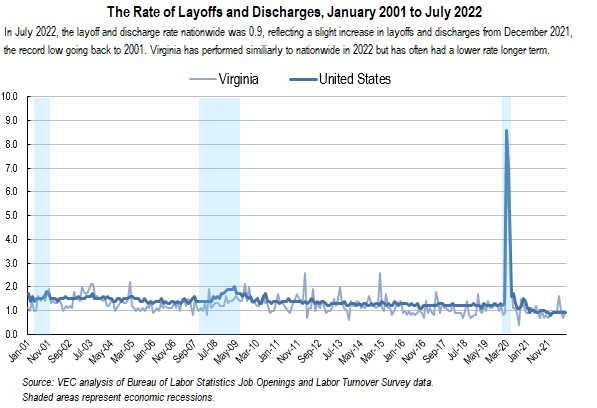

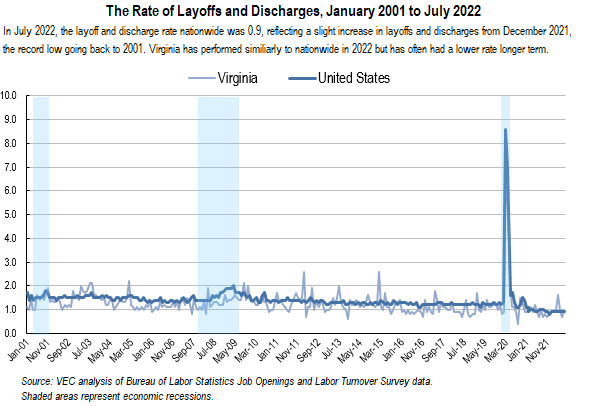

The number of layoffs and discharges in Virginia rebounded by 7,000 to 36,000 in July 2022 from June’s revised 29,000 figure. This was an increase of a third over the year, but nearly 15% lower than five years before in 2018. In July, the number of layoffs and discharges nationwide was little changed at 1.4 million after hitting a series low in April from data going back to January 2001. Layoffs and discharges were little changed in all industries. The layoffs and discharges rate increased in establishments with 250 to 999 employees but decreased in establishments with 1,000 to 4,999 employees. The largest increases in layoffs and discharges rates occurred in Mississippi (+0.6 percentage point), Minnesota (+0.5 point), and Ohio (+0.4 point). Layoffs and discharges are countercyclical, which means that layoffs typically increase during economic contractions and decrease during economic expansions.

The July 2022 churn rate (the sum of the hires rate and the total separations rate) rose to 8.8 from June’s revised 8.0 rate in Virginia, indicating continued elevated velocity of movement into and out of jobs. Nationwide, the July 2022 churn rate was little changed over the month and lower than Virginia’s, indicating slightly slower velocity heading into the second half of 2022. An elevated churn rate indicates a labor market with a high hires rate, a high separations rate, or both. It can signify that workers are moving more frequently into and out of jobs in the labor market. Conversely, a low churn rate indicates a labor market with a low hires rate, a low separations rate, or both. Labor markets with the most churn may also have more seasonal employment patterns not fully captured by seasonal adjustment factors, which can lead to more frequent job-to-job movement.

2022 JOLTS figures show yet another month of a hot job market in which workers were able to consider multiple options and employers were still eager to hire. This was evidenced in the number of workers quitting their jobs. In every month going back a year, at least 100,000 Virginia workers left their job if you count February’s 97,000 figure. This has never happened before, going back to 2001. Over 70% of total separations in July were quits and may be an indication of continued worker confidence in their chances to find a better job. At the same time, both hires and job openings continued to greatly exceed the number of quits nationwide, with Virginia hiring especially resilient in July. Many believe that the U.S. economy is slowing down, but hiring managers didn’t seem to agree. Employers have struggled to build back their staffs to where they want them. An explanation for this may be that, now that they have employees again, employers want to hold on to them, refraining from additional layoffs to hedge their bets to not have churn again, which is so costly.

###

The Virginia Employment Commission plans to release the August 2022 analysis of the BLS Job Openings and Labor Turnover Survey for Virginia on Monday, October 24, 2022. The data for all states and the U.S. will be available on the BLS website JOLTS page, at https://www.bls.gov/jlt/. BLS is scheduled to release the August JOLTS data for states on Wednesday, October 19, 2022.

Technical note: The Bureau of Labor Statistics (BLS) Job Openings and Labor Turnover Survey (JOLTS) produces monthly data on U.S. and regional job openings, hires, quits, layoffs and discharges, and other separations from a sample of approximately 21,000 establishments. As a supplement, BLS has begun publishing state estimates that provide monthly information that can be used to better understand the dynamic activity of businesses in state economies that leads to aggregate employment changes. For more information on the program’s concepts and methodology, see “Job Openings and Labor Turnover Survey: Handbook of Methods (Washington, DC: U.S. Bureau of Labor Statistics, July 13, 2020), https://www.bls.gov/opub/hom/jlt/home.htm. For more information on BLS’ state JOLTS estimates, see https://www.bls.gov/jlt/jlt_statedata.htm.

Definitions of JOLTS terms*

Job Openings

Job openings include all positions that are open on the last business day of the reference month. A job is open only if it meets the following three conditions: (1) A specific position exists and there is work available for that position; the position can be full time or part time, and it can be permanent, short term, or seasonal; (2) the job could start within 30 days, whether or not the employer can find a suitable candidate during that time; and (3) the employer is actively recruiting workers from outside the establishment to fill the position. Excluded are positions open only to internal transfers, promotions or demotions, or recalls from layoffs.

Hires

Hires include all additions to the payroll during the entire reference month, including newly hired and rehired employees; full-time and part-time employees; permanent, short-term, and seasonal employees; employees who were recalled to a job at the location following a layoff (formal suspension from pay status) lasting more than 7 days; on-call or intermittent employees who returned to work after having been formally separated; workers who were hired and separated during the month; and transfers from other locations. Excluded are transfers or promotions within the reporting location, employees returning from a strike, and employees of temporary help agencies, employee leasing companies, outside contractors, or consultants.

Separations

Separations include all separations from the payroll during the entire reference month and are reported by type of separation: quits, layoffs and discharges, and other separations. Quits include employees who left voluntarily, except for retirements or transfers to other locations. Layoffs and discharges include involuntary separations initiated by the employer, including layoffs with no intent to rehire; layoffs (formal suspensions from pay status) lasting or expected to last more than 7 days; discharges resulting from mergers, downsizing, or closings; firings or other discharges for cause; terminations of permanent or short-term employees; and terminations of seasonal employees (whether or not they are expected to return the next season). Other separations include retirements, transfers to other locations, separations due to employee disability, and deaths. Excluded are transfers within the same location, employees on strike, and employees of temporary help agencies, employee leasing companies, outside contractors, or consultants.

*Excerpted from U.S. Bureau of Labor Statistics, Handbook of Methods, Job Openings and Labor Turnover Survey: Concepts, https://www.bls.gov/opub/hom/jlt/concepts.htm.

PDF of Press Release

PDF of Press Release