Converted Word Document

Virginia’s September Unemployment Rate decreased by 0.1 percentage points to 3.5 percent – Total Non-farm Employment increased over the year

RICHMOND— Virginia Works – the Commonwealth’s Department of Workforce Development and Advancement – announced today that Virginia’s seasonally adjusted unemployment rate in September decreased by 0.1 percentage points to 3.5 percent, which is 0.6 percentage points above the rate from a year ago. According to household survey data in September, the labor force decreased by 7,418 to 4,540,292 as the number of unemployed residents decreased by 2,631 to 160,199. The number of employed residents decreased by 4,787 to 4,380,093 according to the Local Area Unemployment Statistics (“the household survey”). Virginia’s seasonally adjusted unemployment rate is 0.9 percentage points below the national rate, which increased by 0.1 percentage points to 4.4 percent.

The Commonwealth’s labor force participation rate decreased by 0.1 percentage points to 64.6 percent in September. The labor force participation rate measures the proportion of the civilian population age 16 and older that is employed or actively looking for work.

In September’s Current Employment Statistics Survey, Virginia’s nonagricultural employment decreased by 5,000 to 4,278,400. August’s preliminary estimate of employment, after revision, increased by 1,800 to 4,283,400. In September, private sector employment decreased by 200 to 3,518,800 while government employment decreased by 4,800 to 759,600. Within that sector, federal government jobs decreased by 800 to 185,400, state government employment decreased by 5,000 to 160,800, and local government increased by 1,000 to 413,400 over the month.

Seasonally adjusted total nonfarm employment data is produced for eleven industry sectors. In September, four experienced over-the-month job gains, two remained unchanged, and five experienced a decline. The largest job gain occurred in Financial Activities (+2,300) to 222,100. The second largest job gain occurred in Trade, Transportation, and Utilities (+1,600) to 680,800. The third largest job gain occurred in Construction (+1,200) to 233,500. The other gain was in Miscellaneous Services (+1,000) to 210,000.

The largest job loss occurred in Government (-4,800) to 759,600. The second largest job loss occurred in Leisure and Hospitality (-2,700) to 414,300. The third largest job loss occurred in Education and Health Services (-1,600) to 637,300. The other losses were in Manufacturing (-1,200) to 237,200; and Information (-800) to 69,100.

Mining and Logging; and Professional and Business Services remained unchanged.

Nonfarm Employment in Virginia* Seasonally Adjusted |

|

Industry | Employment | August 2025 to September 2025 | September 2024 to September 2025 |

September 2025 | August 2025 | September 2024 | Change | % Change | Change | % Change |

Total Nonfarm | 4,278,400 | 4,283,400 | 4,250,200 | -5,000 | -0.1% | 28,200 | 0.7% |

Total Private | 3,518,800 | 3,519,000 | 3,494,100 | -200 | -0.0% | 24,700 | 0.7% |

Goods Producing | 477,800 | 477,800 | 470,200 | 0 | 0.0% | 7,600 | 1.6% |

Mining and Logging | 7,100 | 7,100 | 7,400 | 0 | 0.0% | -300 | -4.1% |

Construction | 233,500 | 232,300 | 220,000 | 1,200 | 0.5% | 13,500 | 6.1% |

Manufacturing | 237,200 | 238,400 | 242,800 | -1,200 | -0.5% | -5,600 | -2.3% |

Service-Providing | 3,800,600 | 3,805,600 | 3,780,000 | -5,000 | -0.1% | 20,600 | 0.5% |

Private Service Providing | 3,041,000 | 3,041,200 | 3,023,900 | -200 | -0.0% | 17,100 | 0.6% |

Trade, Transportation, and Utilities | 680,800 | 679,200 | 679,100 | 1,600 | 0.2% | 1,700 | 0.3% |

Information | 69,100 | 69,900 | 70,000 | -800 | -1.1% | -900 | -1.3% |

Financial Activities | 222,100 | 219,800 | 221,200 | 2,300 | 1.0% | 900 | 0.4% |

Professional and Business Services | 807,400 | 807,400 | 818,200 | 0 | 0.0% | -10,800 | -1.3% |

Education and Health Services | 637,300 | 638,900 | 614,500 | -1,600 | -0.3% | 22,800 | 3.7% |

Leisure and Hospitality | 414,300 | 417,000 | 415,500 | -2,700 | -0.6% | -1,200 | -0.3% |

Miscellaneous Services | 210,000 | 209,000 | 205,400 | 1,000 | 0.5% | 4,600 | 2.2% |

Government | 759,600 | 764,400 | 756,100 | -4,800 | -0.6% | 3,500 | 0.5% |

Federal Government | 185,400 | 186,200 | 194,100 | -800 | -0.4% | -8,700 | -4.5% |

State Government | 160,800 | 165,800 | 159,700 | -5,000 | -3.0% | 1,100 | 0.7% |

Local Government | 413,400 | 412,400 | 402,300 | 1,000 | 0.2% | 11,100 | 2.8% |

*Current month’s estimates are preliminary.

From September 2024 to September 2025, Virginia Works estimates that total nonfarm employment in Virginia increased by 28,200 to 4,278,400, private sector employment increased by 24,700 to 3,518,800, and government employment increased by 3,500 to 759,600 jobs. Within that sector, federal government jobs decreased by 8,700 to 185,400, state government employment increased by 1,100 to 160,800, and local government increased by 11,100 to 413,400 over the year.

For the eleven industry sectors in Virginia over the year, six experienced over-the-year job gains, and five experienced a decline. The largest job gain occurred in Education and Health Services (+22,800) to 637,300. The second largest job gain occurred in Construction (+13,500) to 233,500. The third largest job gain occurred in Miscellaneous Services (+4,600) to 210,000. The other gains were in Government (+3,500) to 759,600; Trade, Transportation, and Utilities (+1,700) to 680,800; and Financial Activities (+900) to 222,100.

The largest job loss occurred in Professional and Business Services (-10,800) to 807,400. The second largest job loss occurred in Manufacturing (-5,600) to 237,200. The third largest job loss occurred in Leisure and Hospitality (-1,200) to 414,300. The other losses were in Information (-900) to 69,100; and Mining and Logging (-300) to 7,100.

Nonfarm Employment in Virginia* Seasonally Adjusted |

|

Area | Employment | August 2025 to September 2025 | September 2024 to September 2025 |

September 2025 | August 2025 | September 2024 | Change | % Change | Change | % Change |

Virginia | 4,278,400 | 4,283,400 | 4,250,200 | -5,000 | -0.1% | 28,200 | 0.7% |

Arlington-Alexandria MSA | 1,635,600 | 1,635,700 | 1,632,300 | -100 | -0.0% | 3,300 | 0.2% |

Blacksburg-Christiansburg-Radford MSA | 82,300 | 82,400 | 82,400 | -100 | -0.1% | -100 | -0.1% |

Charlottesville MSA | 126,300 | 126,200 | 124,400 | 100 | 0.1% | 1,900 | 1.5% |

Harrisonburg MSA | 70,400 | 71,200 | 71,800 | -800 | -1.1% | -1,400 | -1.9% |

Lynchburg MSA | 104,500 | 104,800 | 103,600 | -300 | -0.3% | 900 | 0.9% |

Richmond MSA | 734,000 | 734,900 | 723,000 | -900 | -0.1% | 11,000 | 1.5% |

Roanoke MSA | 168,100 | 167,900 | 167,700 | 200 | 0.1% | 400 | 0.2% |

Staunton MSA | 54,200 | 53,900 | 54,000 | 300 | 0.6% | 200 | 0.4% |

Virginia Beach-Chesapeake-Norfolk MSA | 821,200 | 822,600 | 825,200 | -1,400 | -0.2% | -4,000 | -0.5% |

Winchester MSA | 75,000 | 74,600 | 72,700 | 400 | 0.5% | 2,300 | 3.2% |

*Current month’s estimates are preliminary.

Seasonally adjusted total nonfarm employment data is produced for ten metropolitan areas. In September, four experienced over-the-month job gains, and six experienced a decline. The largest job gain occurred in Winchester (+400) to 75,000. The second largest job gain occurred in Staunton (+300) to 54,200. The third largest job gain occurred in Roanoke (+200) to 168,100. The other gain was in Charlottesville (+100) to 126,300.

The largest job loss occurred in Virginia Beach-Chesapeake-Norfolk (-1,400) to 821,200. The second largest job loss occurred in Richmond (-900) to 734,000. The third largest job loss occurred in Harrisonburg (-800) to 70,400. The other losses were in Lynchburg (-300) to 104,500; Arlington-Alexandria (-100) to 1,635,600; and Blacksburg-Christiansburg-Radford (-100) to 82,300.

Over the year, seven metro areas experienced over-the-year job gains, and three experienced a decline. The largest job gain occurred in Richmond (+11,000) to 734,000. The second largest job gain occurred in Arlington-Alexandria (+3,300) to 1,635,600. The third largest job gain occurred in Winchester (+2,300) to 75,000. The other gains were in Charlottesville (+1,900) to 126,300; Lynchburg (+900) to 104,500; Roanoke (+400) to 168,100; and Staunton (+200) to 54,200.

The largest job loss occurred in Virginia Beach-Chesapeake-Norfolk (-4,000) to 821,200. The second largest job loss occurred in Harrisonburg (-1,400) to 70,400. The third largest job loss occurred in Blacksburg-Christiansburg-Radford (-100) to 82,300.

Not Seasonally Adjusted Data

Virginia’s unadjusted unemployment rate decreased by 0.5 percentage points to 3.4 percent in September. It has increased by 0.5 percentage points to 3.4 percent compared to last year. Compared to a year ago, the number of unemployed increased by 17,882 to 150,956, household employment decreased by 98,381 to 4,354,424, and the labor force decreased by 80,499 to 4,505,380. Virginia’s not seasonally adjusted unemployment rate is 0.9 percentage points below the national unadjusted rate, which decreased by 0.2 percentage points to 4.3 percent.

Compared to last month, the September unadjusted workweek for Virginia’s 153,600 manufacturing production workers increased by 0.5 to 38.8 hours. Average hourly earnings of private-sector production workers increased by $0.03 to $28.57, and average weekly earnings increased by $15.44 to $1,108.52.

###

Technical note: Estimates of unemployment and industry employment levels are obtained from two separate monthly surveys. Resident employment and unemployment data are mainly derived from the Virginia portion of the national Current Population Survey (CPS), a household survey conducted each month by the U.S. Census Bureau under contract with BLS, which provides input to the Local Area Unemployment Statistics (LAUS) program (often referred to as the “household” survey). Industry employment data is mainly derived from the Current Employment Statistics (CES) survey, a monthly survey of approximately 18,000 Virginia businesses conducted by BLS, which provides estimates of employment, hours, and earnings data broken down by industry for the nation as a whole, all states and most major metropolitan areas (often referred to as the “establishment” survey). Both industry and household estimates are revised each month based on additional information from updated survey reports compiled by the BLS. For national figures and information on how COVID-19 affected collection of the BLS establishment and household surveys in April 2020, refer to the BLS September Employment Situation press release for details.

The statistical reference week for the household survey this month was the week of September 7-13, 2025

Virginia Works plans to release the September local area unemployment rates on Wednesday December 17, 2025. The data will be available on our website www.VirginiaWorks.com. The November 2025 statewide unemployment rate and employment data for both the state and metropolitan areas are scheduled to be released on Wednesday January 7, 2026. |

Sep 25 CES Distribution Publication File

Sep 25 CES Distribution Publication File

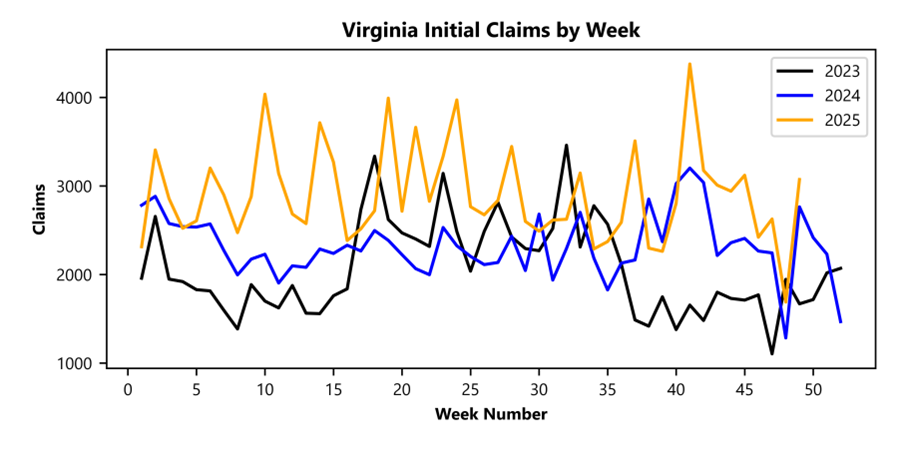

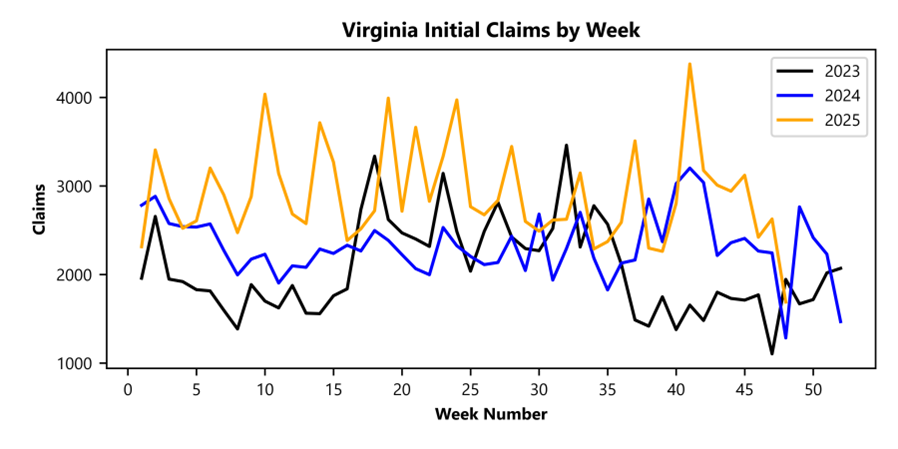

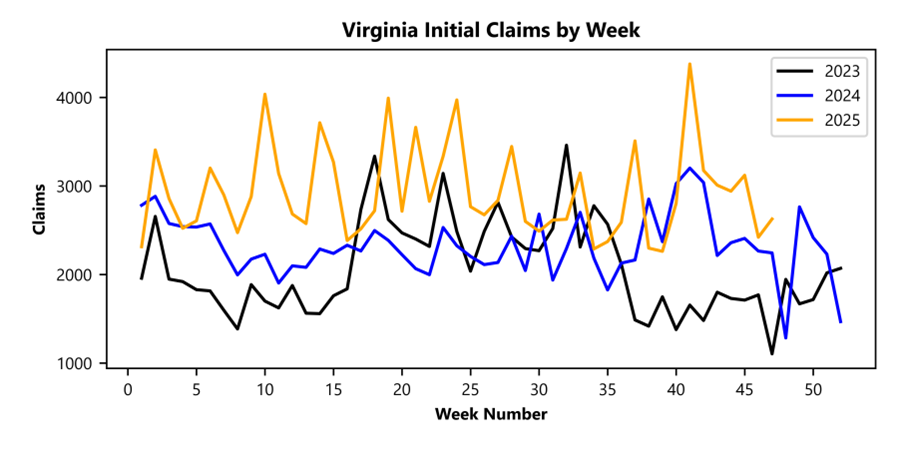

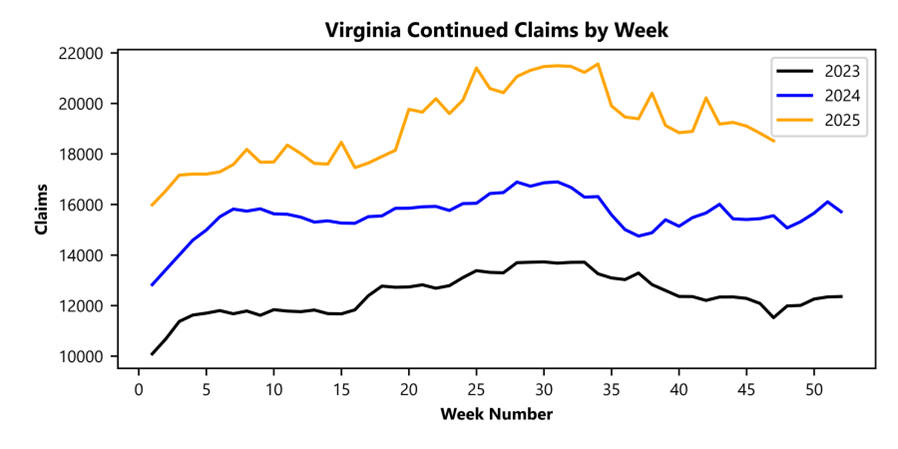

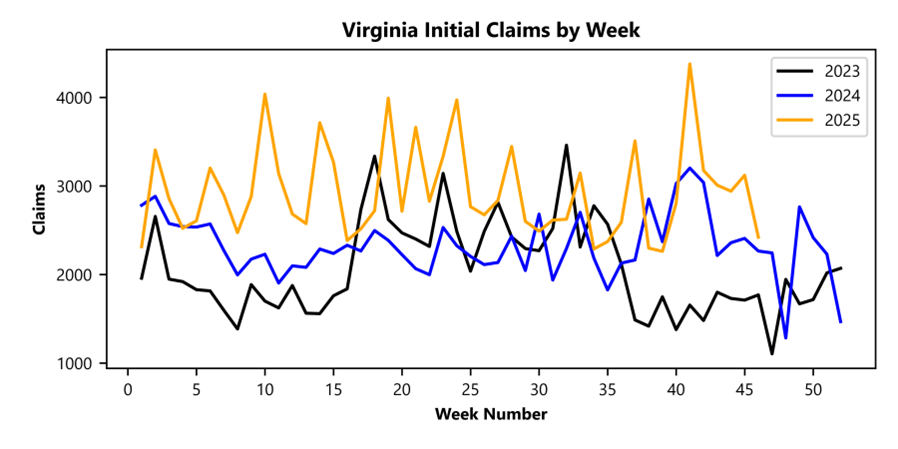

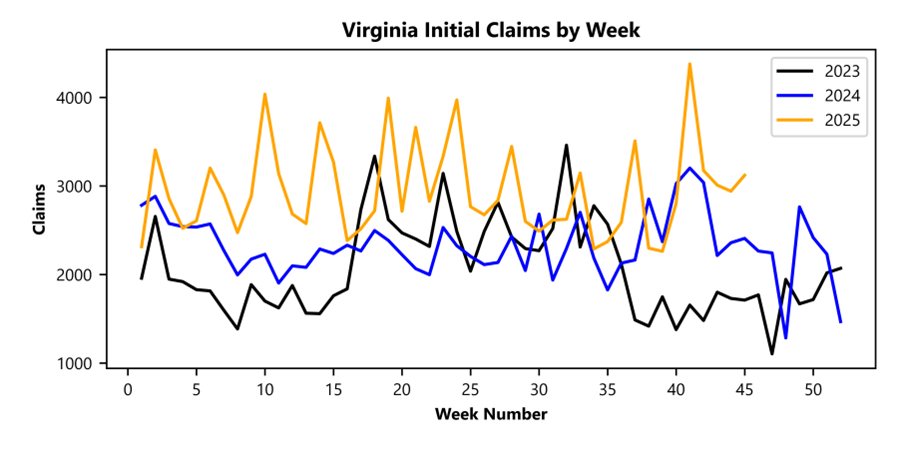

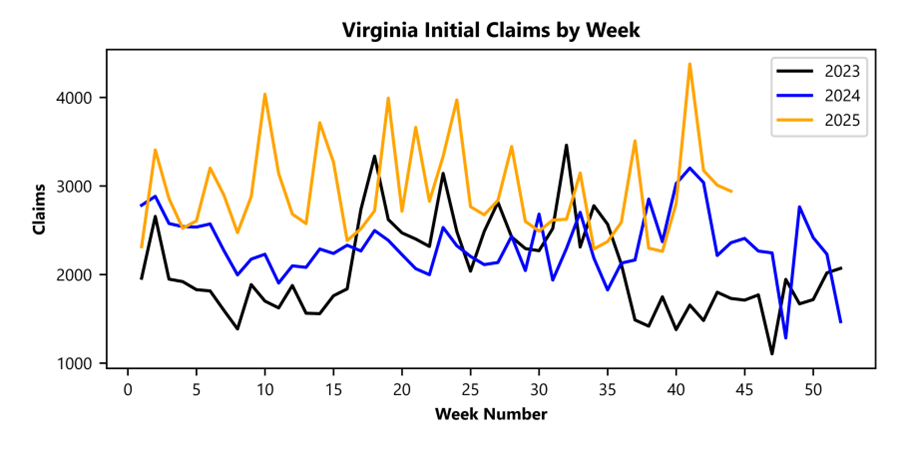

RICHMOND— Virginia Works announced today that 3,073 unemployment insurance weekly initial claims were filed during the week ending December 06, 2025, which is 81.9 percent higher than last week’s 1,689 claims and 11.2 percent higher than the comparable week of last year (2,764). Nearly 72 percent of claimants self-reported an employer which correlates to an associated industry. Based on this reporting, the top five industries (58 percent) were Professional, Scientific, and Technical Services (365); Administrative and Support and Waste Management (289); Accommodation and Food Services (217); Health Care and Social Assistance (213); and Manufacturing (184).

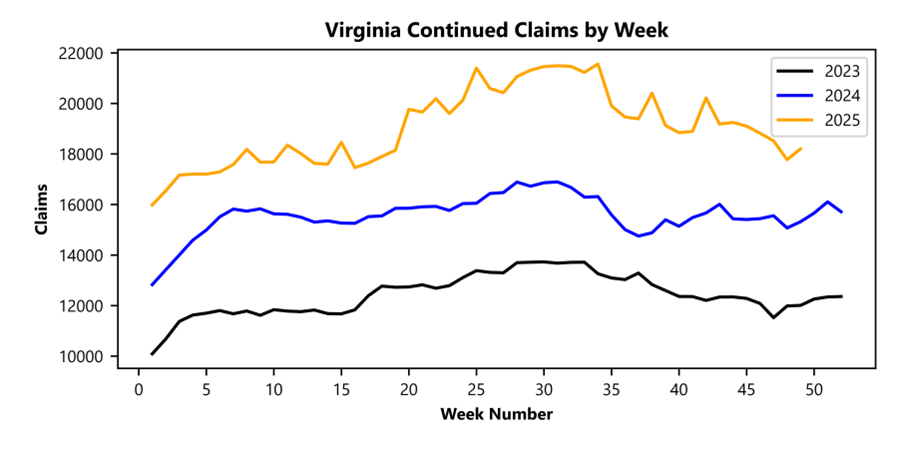

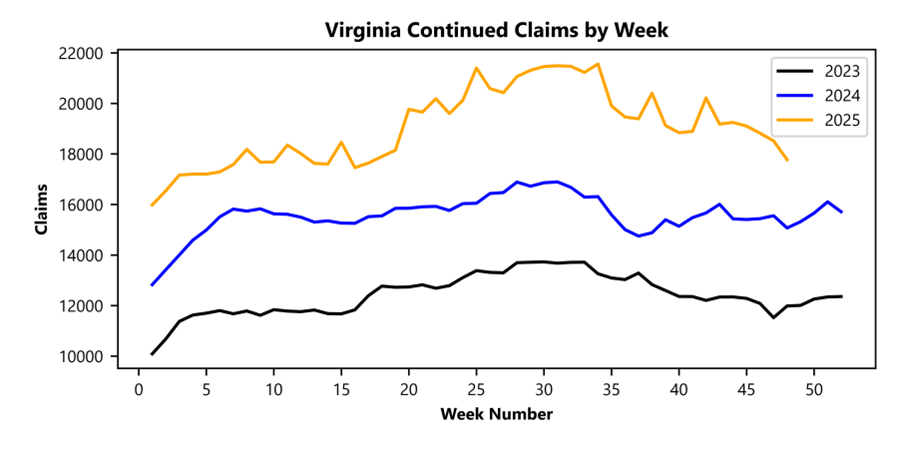

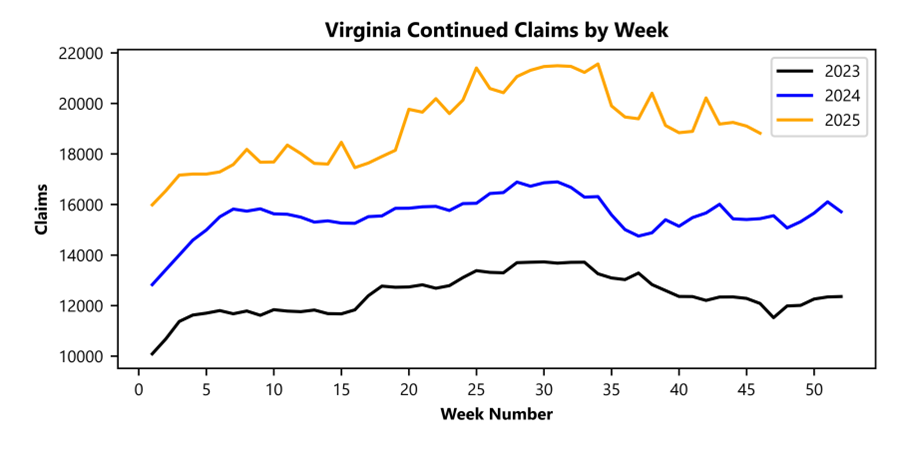

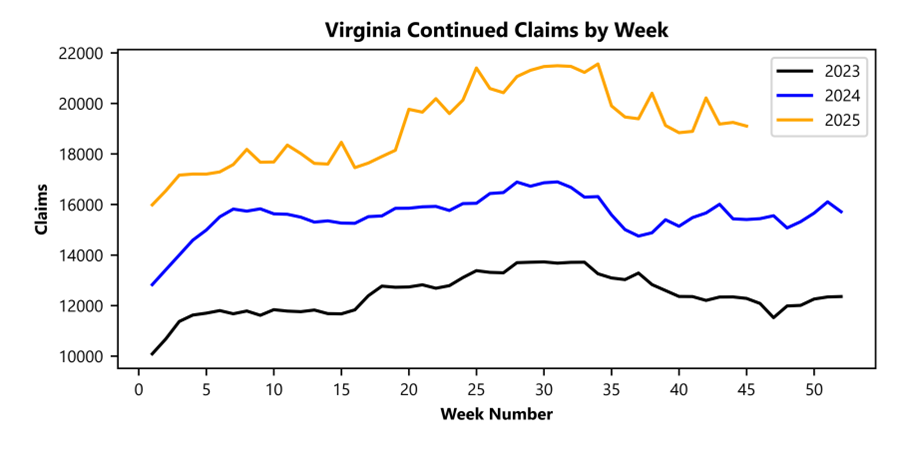

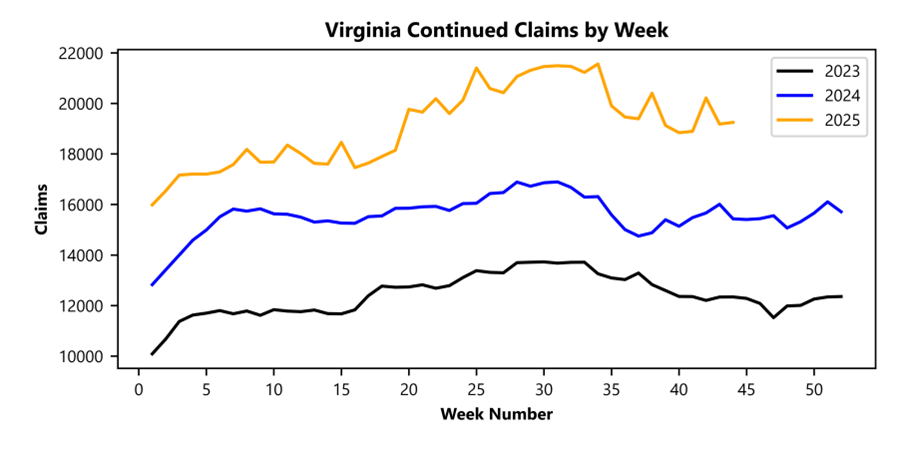

Continued weeks claims (18,201) were 2.4 percent higher than last week (17,773) and were 18.8 percent higher than the comparable week of last year (15,318). Nearly 92 percent of claimants self-reported an employer which correlates to an associated industry. Based on this reporting, the top five industries (63 percent) were Professional, Scientific, and Technical Services (4,288); Administrative and Support and Waste Management (2,159); Health Care and Social Assistance (1,526); Manufacturing (1,288); and Retail Trade (1,260).

Significant Layoffs and Announcements are available at the following websites:

WARN Notices | Virginia Works

Announcements | Virginia Economic Development Partnership

|

Unemployment

Claims Activity Comparison

|

|

|

Week

Ending 12/06/2025

|

Week

Ending 11/29/2025

|

Week

Ending 11/22/2025

|

Last

Year 12/07/2024

|

|

Initial

Claims

|

3,073

|

1,689

|

2,627

|

2,764

|

|

Initial Change (%)

|

+1384 (+81.9%)

|

-938 (-35.7%)

|

+206 (+8.5%)

|

+309 (+11.2%)

|

|

Continued

Claims

|

18,201

|

17,773

|

18,516

|

15,318

|

|

Continued

Change (%)

|

+428 (+2.4%)

|

-743 (-4.0%)

|

-302 (-1.6%)

|

+2883 (+18.8%)

|

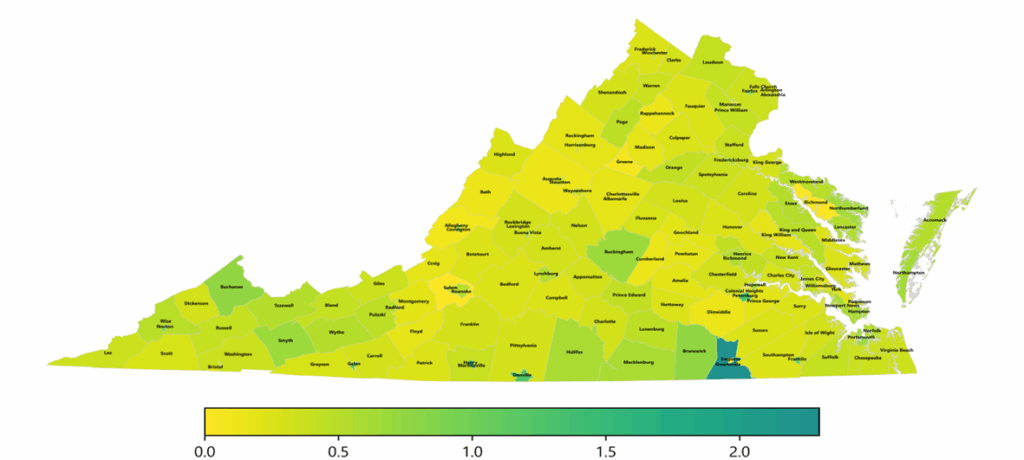

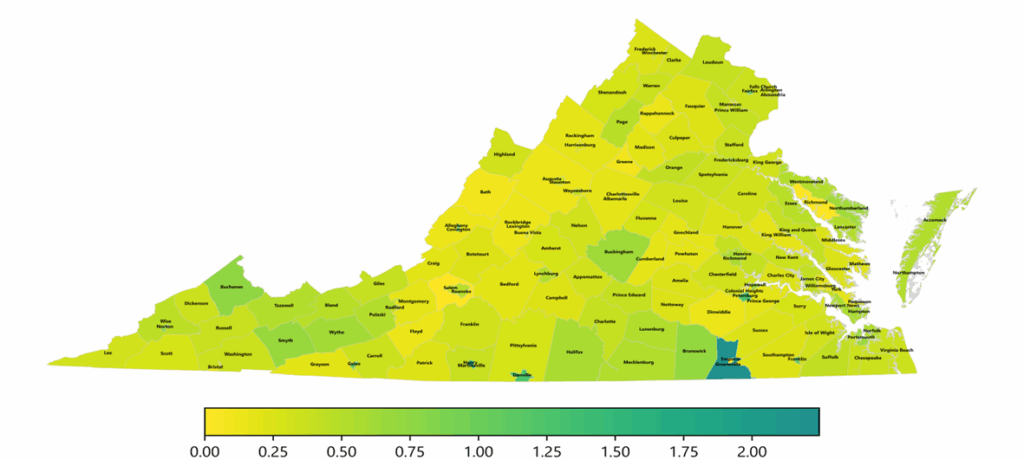

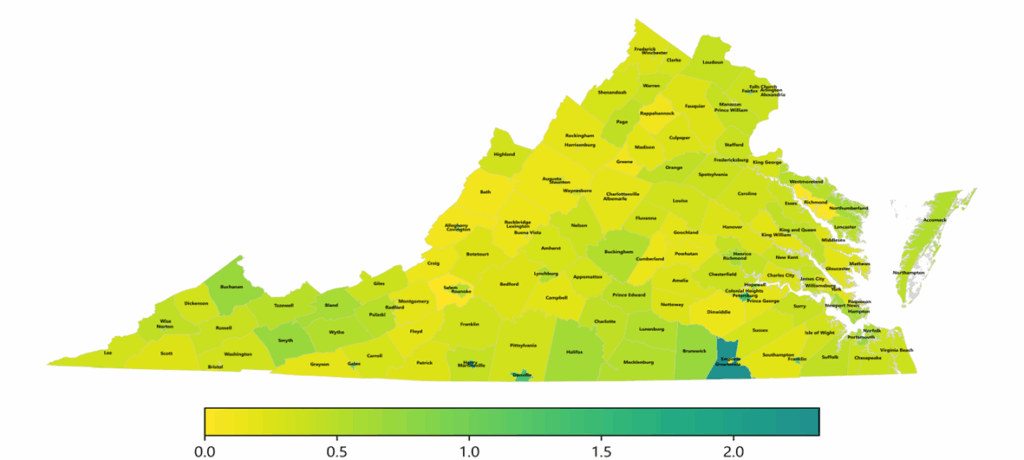

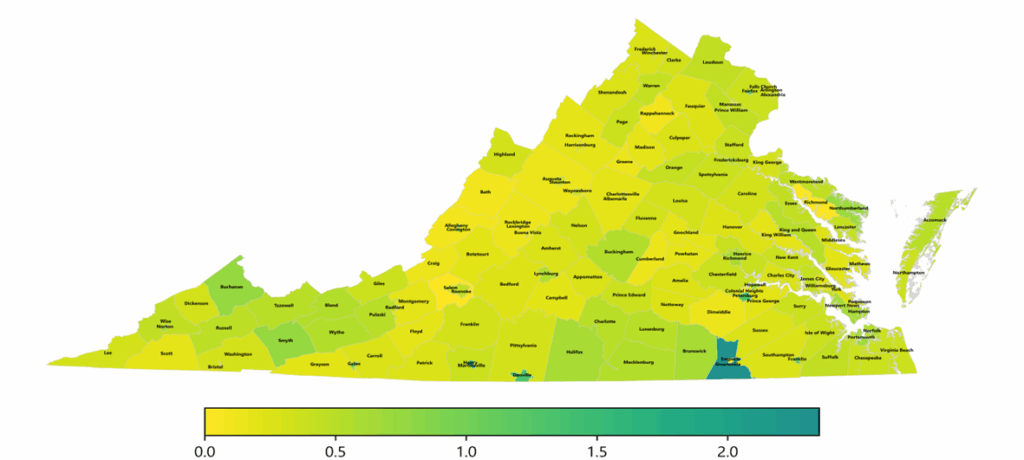

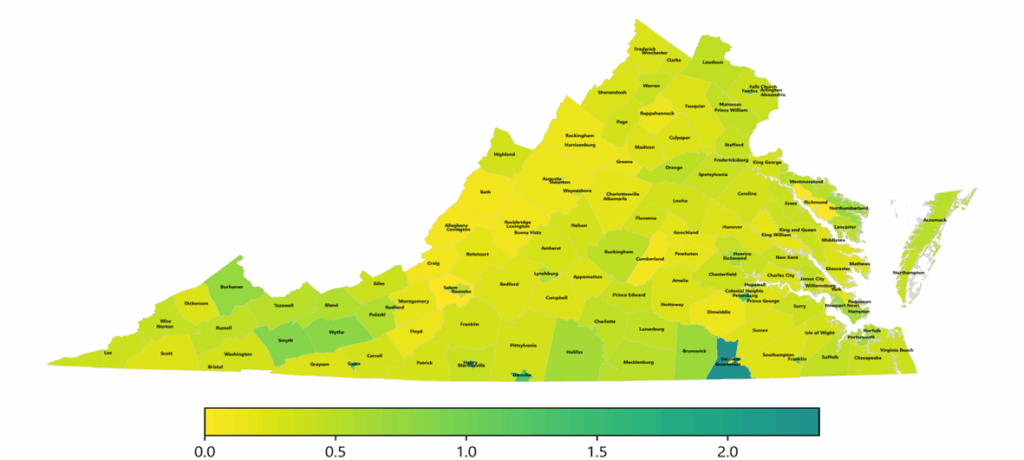

Virginia Continued Weeks Claimed as a Percentage of Total Workforce

A person who has already filed an initial claim and who has experienced a week of unemployment files a continued claim to claim benefits for that week of unemployment. On a weekly basis, continued claims reflect a good approximation of the current number of insured unemployed workers filing for UI benefits, and are a good indicator of labor market conditions. While continued claims are not a leading indicator, they provide confirming evidence of the direction of the economy.

The color-coded map below shows the distribution of this week’s continued claims in Virginia’s counties and cities, expressed as a percentage of each locality’s labor force. This approach provides a more meaningful comparison across areas by adjusting for differences in labor force size. Yellow represents a lower percentage of continued claims relative to the labor force, while progressively darker shades transitioning from yellow to green and dark green indicate higher percentages. The legend at the bottom shows the color spectrum and its corresponding percentage ranges.

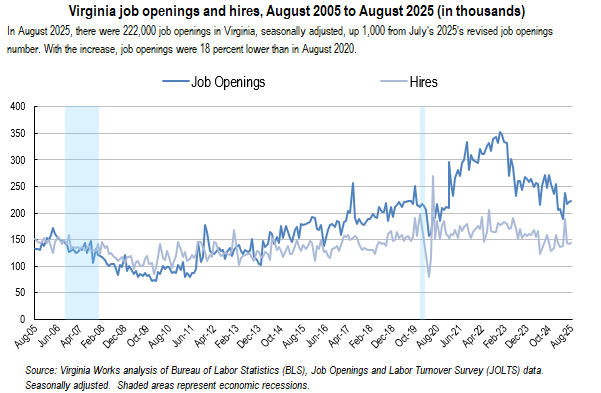

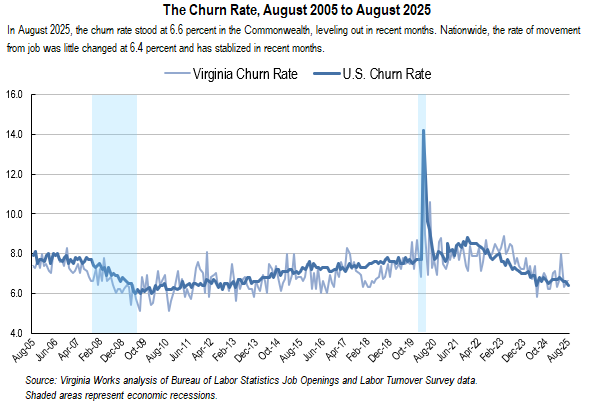

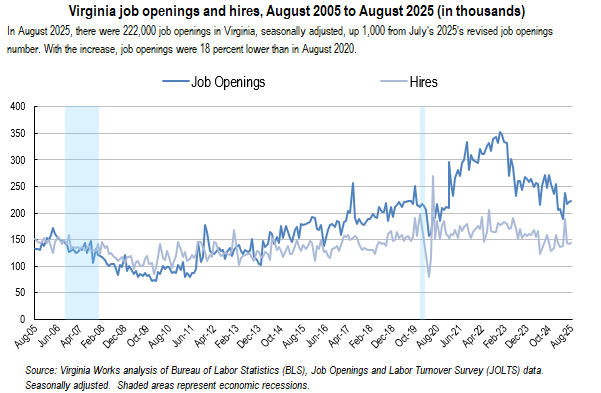

RICHMOND Virginia Works (the

Virginia Department of Workforce Development and Advancement) announced today

that the U.S. Bureau of Labor Statistics (BLS) August 2025 Job Openings and

Labor Turnover Survey (JOLTS) reports steady levels of job separations, buoyed

by a rise in job quitting.

On

the last business day in August, there were 222,000 job openings in

Virginia, seasonally adjusted, an increase of 1,000 from July s upwardly revised

figure of 221,000. Job openings were 18 percent lower than August 2024 s

figure. Nationwide, the number and rate of job openings was unchanged at 7.2

million, in August. The number of U.S. job openings significantly decreased in

construction (-115,000) and in federal government (-61,000). The Virginia job

openings rate was little changed at 4.9 percent. Nationwide, the job

openings rate stood at 4.3 percent.

The

number of hires in Virginia was 144,000 in August, up by 2,000 from July s

revised figure and little changed over the year. JOLTS defines hires as all

additions to the payroll during the month. In August, the

number of U.S. hires was little changed at 5.1 million.

In

Virginia, the 3.4 percent hires rate was little changed over the month.

The U.S. rate of hires nationwide was little changed at 3.2 percent.

The

Virginia hires-per-job-opening (HPJO) ratio was two hires for every

three job openings, which was slightly lower than the nationwide rate of seven

hires for every ten job openings. This measure shows the rate of hiring

compared to open jobs and is a proxy for time to fill positions. In August

2025, there were 0.7 unemployed per job opening in the Commonwealth,

compared to one unemployed per job opening nationwide.

Total

job

separations in Virginia was unchanged at 137,000.

Nationwide, the number of total separations in August was little changed at 5.1

million. The Virginia total separations rate stood at 3.2 percent.

Nationwide, the total separations rate remained little changed at 3.2 percent. The

total number of separations decreased significantly in accommodation and food

services (-113,000) and in arts, entertainment, and recreation (-48,000). Total

separations increased in state and local government, excluding education

(+27,000).

An

estimated 91,000 workers quit jobs ( quits ) from Virginia employers in August,

up by 12,000 over the month. Nationwide in August, the number of quits was

little changed at 3.1 million. The number of quits decreased in accommodation

and food services (-140,000) and in arts, entertainment, and recreation

(-22,000). Quits increased in construction (+56,000). The quits rate in the

Commonwealth was unchanged at 2.1 percent. Over the month, the U.S. quits rate

was little changed at 1.9 percent.

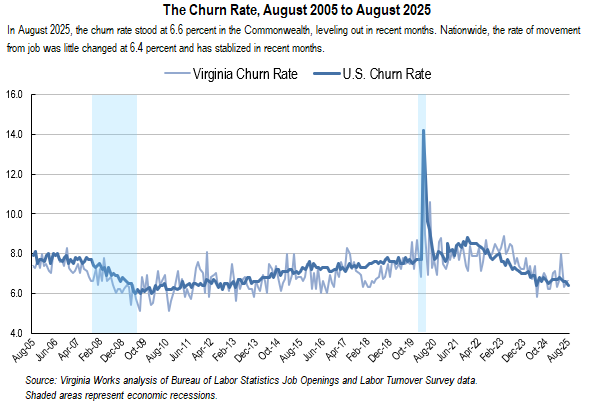

The

August churn rate (the sum of the

hires

and total separations rates) in Virginia increased by 0.1 percentage points

from July s revised figure and was driven by an increase

in job quits. It equaled the U.S. churn rate, which was little changed over the

month.

The

number of layoffs and discharges in Virginia was 40,000 in August, a decrease

of 11,000 from July s revised estimate. In August, the number of U.S. layoffs

and discharges was unchanged at 1.7 million. Layoffs and discharges decreased

in wholesale trade (-36,000) and in federal government (-4,000). The Virginia layoffs

and discharges rate fell to 0.9 percent. In August, the U.S. rate of

layoffs and discharges was unchanged at 1.1 percent.

On

the last business day of August, JOLTS data indicated that labor market

conditions improved, with decreases in layoffs and increases in job quits.

BLS s

JOLTS data provides information on all the components that make up the net

change in the number of jobs over a month, including job openings, hires,

layoffs, voluntary quits, and other job separations (including retirements and

worker deaths). Together, these components attempt to reveal the overall change

in payroll employment. JOLTS data is seasonally adjusted and describes

conditions on the last business day of the month. The current month s data is

preliminary and the previous month s data has been revised.

|

Job Openings

Job openings include all positions that

are open on the last business day of the reference month. A job is open only

if it meets the following three conditions: (1) A specific position exists

and there is work available for that position; the position can be full time

or part time, and it can be permanent, short term, or seasonal; (2) the job

could start within 30 days, whether or not the employer can find a suitable

candidate during that time; and (3) the employer is actively recruiting

workers from outside the establishment to fill the position. Excluded are

positions open only to internal transfers, promotions or demotions, or

recalls from layoffs.

Hires

Hires include all additions to the payroll

during the entire reference month, including newly hired and rehired

employees; full-time and part-time employees; permanent, short-term, and

seasonal employees; employees who were recalled to a job at the location

following a layoff (formal suspension from pay status) lasting more than 7

days; on-call or intermittent employees who returned to work after having

been formally separated; workers who were hired and separated during the

month; and transfers from other locations. Excluded are transfers or

promotions within the reporting location, employees returning from a strike,

and employees of temporary help agencies, employee leasing companies, outside

contractors, or consultants.

Separations

Separations include all separations from

the payroll during the entire reference month and are reported by type of

separation: quits, layoffs and discharges, and other separations. Quits

include employees who left voluntarily, except for retirements or transfers

to other locations. Layoffs and discharges include involuntary separations

initiated by the employer, including layoffs with no intent to rehire;

layoffs (formal suspensions from pay status) lasting or expected to last more

than 7 days; discharges resulting from mergers, downsizing, or closings;

firings or other discharges for cause; terminations of permanent or

short-term employees; and terminations of seasonal employees (whether or not

they are expected to return the next season). Other separations include

retirements, transfers to other locations, separations due to employee

disability, and deaths. Excluded are transfers within the same location,

employees on strike, and employees of temporary help agencies, employee

leasing companies, outside contractors, or consultants.

*Excerpted from U.S. Bureau of Labor

Statistics, Handbook of Methods, "Job Openings and Labor Turnover

Survey: Concepts," https://www.bls.gov/opub/hom/jlt/concepts.htm.

|

Virginia

Works plans to release the October 2025 analysis of the BLS Job Openings and Labor Turnover Survey for Virginia on Friday,

December 19, 2025. The data for all states and the U.S. will be available on the BLS website JOLTS page, at https://www.bls.gov/jlt/. BLS

is scheduled to release the August JOLTS data for states on Wednesday, December

17, 2025.

Technical note:

Effective with the release of May 2025 data, the Job Openings and Labor

Turnover Survey (JOLTS) state estimates have been benchmarked and revised to

include the annual benchmark revisions to JOLTS national estimates, the Current

Employment Statistics (CES) employment estimates, and the Quarterly Census of

Employment and Wages (QCEW) data. Seasonally adjusted and not seasonally

adjusted data from January 2019 forward are subject to revision. The Bureau of

Labor Statistics (BLS) Job Openings and Labor Turnover Survey (JOLTS) produces

monthly data on U.S. and regional job openings, hires, quits, layoffs and

discharges, and other separations from a sample of approximately 21,000

establishments. For more information on the program s concepts

and methodology, see Job Openings and Labor Turnover Survey: Handbook of Methods (Washington,

DC: U.S. Bureau of Labor Statistics, July 13, 2020), https://www.bls.gov/opub/hom/jlt/home.htm. For more information on BLS state JOLTS

estimates, see https://www.bls.gov/jlt/jlt_statedata.htm. Definitions of JOLTS

terms*

Technical note:

Effective with the release of May 2025 data, the Job Openings and Labor

Turnover Survey (JOLTS) state estimates have been benchmarked and revised to

include the annual benchmark revisions to JOLTS national estimates, the Current

Employment Statistics (CES) employment estimates, and the Quarterly Census of

Employment and Wages (QCEW) data. Seasonally adjusted and not seasonally

adjusted data from January 2019 forward are subject to revision. The Bureau of

Labor Statistics (BLS) Job Openings and Labor Turnover Survey (JOLTS) produces

monthly data on U.S. and regional job openings, hires, quits, layoffs and

discharges, and other separations from a sample of approximately 21,000

establishments. For more information on the program s concepts

and methodology, see Job Openings and Labor Turnover Survey: Handbook of Methods (Washington,

DC: U.S. Bureau of Labor Statistics, July 13, 2020), https://www.bls.gov/opub/hom/jlt/home.htm. For more information on BLS state JOLTS

estimates, see https://www.bls.gov/jlt/jlt_statedata.htm. Definitions of JOLTS

terms*

RICHMOND— Virginia Works announced today that 1,689 unemployment insurance weekly initial claims were filed during the week ending November 29, 2025, which is 35.7 percent lower than last week’s 2,627 claims and 31.5 percent higher than the comparable week of last year (1,284). Nearly 84 percent of claimants self-reported an employer which correlates to an associated industry. Based on this reporting, the top five industries (60 percent) were Manufacturing (185); Professional, Scientific, and Technical Services (166); Administrative and Support and Waste Management (158); Accommodation and Food Services (129); and Health Care and Social Assistance (99).

Continued weeks claims (17,773) were 4.0 percent lower than last week (18,516) and were 17.9 percent higher than the comparable week of last year (15,070). Nearly 92 percent of claimants self-reported an employer which correlates to an associated industry. Based on this reporting, the top five industries (63 percent) were Professional, Scientific, and Technical Services (4,228); Administrative and Support and Waste Management (2,112); Health Care and Social Assistance (1,505); Manufacturing (1,238); and Retail Trade (1,234).

Significant Layoffs and Announcements are available at the following websites:

WARN Notices | Virginia Works

Announcements | Virginia Economic Development Partnership

|

Unemployment

Claims Activity Comparison

|

|

|

Week

Ending 11/29/2025

|

Week

Ending 11/22/2025

|

Week

Ending 11/15/2025

|

Last

Year 11/30/2024

|

|

Initial

Claims

|

1,689

|

2,627

|

2,421

|

1,284

|

|

Initial Change (%)

|

-938 (-35.7%)

|

+206 (+8.5%)

|

-700 (-22.4%)

|

+405 (+31.5%)

|

|

Continued

Claims

|

17,773

|

18,516

|

18,818

|

15,070

|

|

Continued

Change (%)

|

-743 (-4.0%)

|

-302 (-1.6%)

|

-282 (-1.5%)

|

+2703 (+17.9%)

|

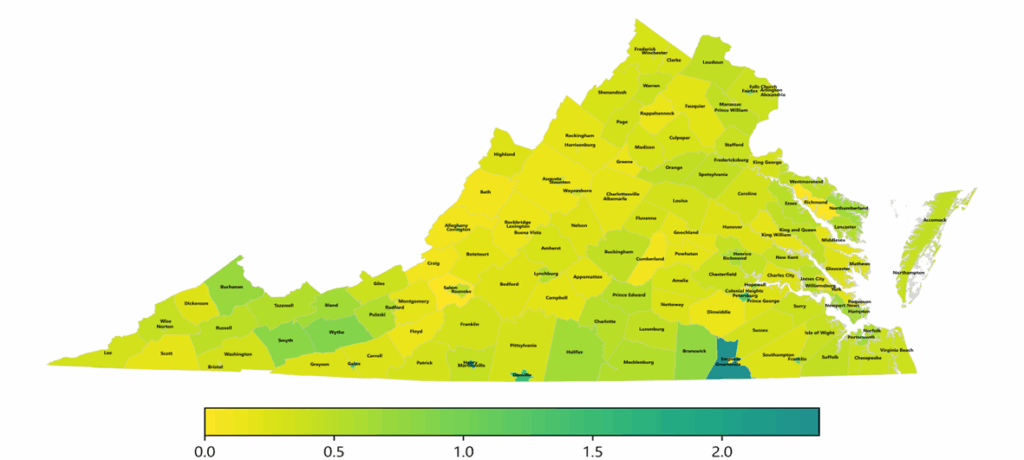

Virginia Continued Weeks Claimed as a Percentage of Total Workforce

A person who has already filed an initial claim and who has experienced a week of unemployment files a continued claim to claim benefits for that week of unemployment. On a weekly basis, continued claims reflect a good approximation of the current number of insured unemployed workers filing for UI benefits, and are a good indicator of labor market conditions. While continued claims are not a leading indicator, they provide confirming evidence of the direction of the economy.

The color-coded map below shows the distribution of this week’s continued claims in Virginia’s counties and cities, expressed as a percentage of each locality’s labor force. This approach provides a more meaningful comparison across areas by adjusting for differences in labor force size. Yellow represents a lower percentage of continued claims relative to the labor force, while progressively darker shades transitioning from yellow to green and dark green indicate higher percentages. The legend at the bottom shows the color spectrum and its corresponding percentage ranges.

Friday December 12, 2025, Galax, Radford, and Wytheville will open at 10:00 AM. All other offices opening at the normal times.

Program Year 2024 marked a transformative milestone for Virginia’s

workforce system with the full operational launch of Virginia Works,

the Commonwealth’s new Department of Workforce Development

and Advancement. As the Commonwealth’s unified workforce

agency, Virginia Works has consolidated 11 programs into a single,

streamlined entity, aligning service delivery, data systems, and

strategic leadership under one mission: We connect people to

careers and employers to skilled talent.

This report highlights the agency’s performance under the

Workforce Innovation and Opportunity Act (WIOA) Titles I and

III, showcasing measurable outcomes, innovative practices, and

regional success stories. Virginia Works exceeded expectations in

several key performance areas, launched multiple pilot programs

through WIOA Governor’s Reserve funds discretionary grants, and

expanded access to underserved communities. The agency also

led the state’s largest-ever virtual hiring initiative, modernized

apprenticeship infrastructure, and strengthened cross-agency

collaboration. With a focus on outcomes, process improvements,

and employer engagement, Virginia Works is laying the foundation

for a more agile and responsive workforce system.

RICHMOND— Virginia Works announced today that 2,627 unemployment insurance weekly initial claims were filed during the week ending November 22, 2025, which is 8.5 percent higher than last week’s 2,421 claims and 17.1 percent higher than the comparable week of last year (2,244). Nearly 81 percent of claimants self-reported an employer which correlates to an associated industry. Based on this reporting, the top five industries (61 percent) were Professional, Scientific, and Technical Services (380); Administrative and Support and Waste Management (277); Health Care and Social Assistance (208); Manufacturing (202); and Retail Trade (191).

Continued weeks claims (18,516) were 1.6 percent lower than last week (18,818) and were 19.0 percent higher than the comparable week of last year (15,554). Nearly 92 percent of claimants self-reported an employer which correlates to an associated industry. Based on this reporting, the top five industries (64 percent) were Professional, Scientific, and Technical Services (4,558); Administrative and Support and Waste Management (2,171); Health Care and Social Assistance (1,555); Retail Trade (1,294); and Manufacturing (1,286).

Significant Layoffs and Announcements are available at the following websites:

WARN Notices | Virginia Works

Announcements | Virginia Economic Development Partnership

|

Unemployment

Claims Activity Comparison

|

|

|

Week

Ending 11/22/2025

|

Week

Ending 11/15/2025

|

Week

Ending 11/08/2025

|

Last

Year 11/23/2024

|

|

Initial

Claims

|

2,627

|

2,421

|

3,121

|

2,244

|

|

Initial Change (%)

|

+206 (+8.5%)

|

-700 (-22.4%)

|

+180 (+6.1%)

|

+383 (+17.1%)

|

|

Continued

Claims

|

18,516

|

18,818

|

19,100

|

15,554

|

|

Continued

Change (%)

|

-302 (-1.6%)

|

-282 (-1.5%)

|

-146 (-0.8%)

|

+2962 (+19.0%)

|

Virginia Continued Weeks Claimed as a Percentage of Total Workforce

A person who has already filed an initial claim and who has experienced a week of unemployment files a continued claim to claim benefits for that week of unemployment. On a weekly basis, continued claims reflect a good approximation of the current number of insured unemployed workers filing for UI benefits, and are a good indicator of labor market conditions. While continued claims are not a leading indicator, they provide confirming evidence of the direction of the economy.

The color-coded map below shows the distribution of this week’s continued claims in Virginia’s counties and cities, expressed as a percentage of each locality’s labor force. This approach provides a more meaningful comparison across areas by adjusting for differences in labor force size. Yellow represents a lower percentage of continued claims relative to the labor force, while progressively darker shades transitioning from yellow to green and dark green indicate higher percentages. The legend at the bottom shows the color spectrum and its corresponding percentage ranges.

RICHMOND— Virginia Works announced today that 2,421 unemployment insurance weekly initial claims were filed during the week ending November 15, 2025, which is 22.4 percent lower than last week’s 3,121 claims and 6.9 percent higher than the comparable week of last year (2,265). Nearly 79 percent of claimants self-reported an employer which correlates to an associated industry. Based on this reporting, the top five industries (57 percent) were Professional, Scientific, and Technical Services (362); Administrative and Support and Waste Management (220); Health Care and Social Assistance (175); Retail Trade (163); and Accommodation and Food Services (137).

Continued weeks claims (18,818) were 1.5 percent lower than last week (19,100) and were 21.9 percent higher than the comparable week of last year (15,438). Nearly 91 percent of claimants self-reported an employer which correlates to an associated industry. Based on this reporting, the top five industries (65 percent) were Professional, Scientific, and Technical Services (4,695); Administrative and Support and Waste Management (2,179); Health Care and Social Assistance (1,568); Manufacturing (1,306); and Retail Trade (1,294).

Significant Layoffs and Announcements are available at the following websites:

WARN Notices | Virginia Works

Announcements | Virginia Economic Development Partnership

|

Unemployment

Claims Activity Comparison

|

|

|

Week

Ending 11/15/2025

|

Week

Ending 11/08/2025

|

Week

Ending 11/01/2025

|

Last

Year 11/16/2024

|

|

Initial

Claims

|

2,421

|

3,121

|

2,941

|

2,265

|

|

Initial Change (%)

|

-700 (-22.4%)

|

+180 (+6.1%)

|

-68 (-2.3%)

|

+156 (+6.9%)

|

|

Continued

Claims

|

18,818

|

19,100

|

19,246

|

15,438

|

|

Continued

Change (%)

|

-282 (-1.5%)

|

-146 (-0.8%)

|

+65 (+0.3%)

|

+3380 (+21.9%)

|

Virginia Continued Weeks Claimed as a Percentage of Total Workforce

A person who has already filed an initial claim and who has experienced a week of unemployment files a continued claim to claim benefits for that week of unemployment. On a weekly basis, continued claims reflect a good approximation of the current number of insured unemployed workers filing for UI benefits, and are a good indicator of labor market conditions. While continued claims are not a leading indicator, they provide confirming evidence of the direction of the economy.

The color-coded map below shows the distribution of this week’s continued claims in Virginia’s counties and cities, expressed as a percentage of each locality’s labor force. This approach provides a more meaningful comparison across areas by adjusting for differences in labor force size. Yellow represents a lower percentage of continued claims relative to the labor force, while progressively darker shades transitioning from yellow to green and dark green indicate higher percentages. The legend at the bottom shows the color spectrum and its corresponding percentage ranges.

RICHMOND— Virginia Works announced today that 3,121 unemployment insurance weekly initial claims were filed during the week ending November 08, 2025, which is 6.1 percent higher than last week’s 2,941 claims and 29.6 percent higher than the comparable week of last year (2,408). Nearly 64 percent of claimants self-reported an employer which correlates to an associated industry. Based on this reporting, the top five industries (63 percent) were Professional, Scientific, and Technical Services (509); Administrative and Support and Waste Management (245); Health Care and Social Assistance (173); Retail Trade (169); and Construction (144).

Continued weeks claims (19,100) were 0.8 percent lower than last week (19,246) and were 24.0 percent higher than the comparable week of last year (15,404). Nearly 91 percent of claimants self-reported an employer which correlates to an associated industry. Based on this reporting, the top five industries (65 percent) were Professional, Scientific, and Technical Services (4,718); Administrative and Support and Waste Management (2,209); Health Care and Social Assistance (1,595); Manufacturing (1,405); and Retail Trade (1,296).

Significant Layoffs and Announcements are available at the following websites:

WARN Notices | Virginia Works

Announcements | Virginia Economic Development Partnership

|

Unemployment

Claims Activity Comparison

|

|

|

Week

Ending 11/08/2025

|

Week

Ending 11/01/2025

|

Week

Ending 10/25/2025

|

Last

Year 11/09/2024

|

|

Initial

Claims

|

3,121

|

2,941

|

3,009

|

2,408

|

|

Initial Change (%)

|

+180 (+6.1%)

|

-68 (-2.3%)

|

-166 (-5.2%)

|

+713 (+29.6%)

|

|

Continued

Claims

|

19,100

|

19,246

|

19,181

|

15,404

|

|

Continued

Change (%)

|

-146 (-0.8%)

|

+65 (+0.3%)

|

-1033 (-5.1%)

|

+3696 (+24.0%)

|

Virginia Continued Weeks Claimed as a Percentage of Total Workforce

A person who has already filed an initial claim and who has experienced a week of unemployment files a continued claim to claim benefits for that week of unemployment. On a weekly basis, continued claims reflect a good approximation of the current number of insured unemployed workers filing for UI benefits, and are a good indicator of labor market conditions. While continued claims are not a leading indicator, they provide confirming evidence of the direction of the economy.

The color-coded map below shows the distribution of this week’s continued claims in Virginia’s counties and cities, expressed as a percentage of each locality’s labor force. This approach provides a more meaningful comparison across areas by adjusting for differences in labor force size. Yellow represents a lower percentage of continued claims relative to the labor force, while progressively darker shades transitioning from yellow to green and dark green indicate higher percentages. The legend at the bottom shows the color spectrum and its corresponding percentage ranges.

RICHMOND— Virginia Works announced today that 2,941 unemployment insurance weekly initial claims were filed during the week ending November 01, 2025, which is 2.3 percent lower than last week’s 3,009 claims and 24.7 percent higher than the comparable week of last year (2,359). Nearly 67 percent of claimants self-reported an employer which correlates to an associated industry. Based on this reporting, the top five industries (65 percent) were Professional, Scientific, and Technical Services (504); Administrative and Support and Waste Management (248); Health Care and Social Assistance (187); Manufacturing (166); and Retail Trade (148).

Continued weeks claims (19,246) were 0.3 percent higher than last week (19,181) and were 24.7 percent higher than the comparable week of last year (15,431). Nearly 91 percent of claimants self-reported an employer which correlates to an associated industry. Based on this reporting, the top five industries (65 percent) were Professional, Scientific, and Technical Services (4,691); Administrative and Support and Waste Management (2,213); Health Care and Social Assistance (1,644); Manufacturing (1,448); and Retail Trade (1,327).

Significant Layoffs and Announcements are available at the following websites:

WARN Notices | Virginia Works

Announcements | Virginia Economic Development Partnership

|

Unemployment

Claims Activity Comparison

|

|

|

Week

Ending 11/01/2025

|

Week

Ending 10/25/2025

|

Week

Ending 10/18/2025

|

Last

Year 11/02/2024

|

|

Initial

Claims

|

2,941

|

3,009

|

3,175

|

2,359

|

|

Initial Change (%)

|

-68 (-2.3%)

|

-166 (-5.2%)

|

-1203 (-27.5%)

|

+582 (+24.7%)

|

|

Continued

Claims

|

19,246

|

19,181

|

20,214

|

15,431

|

|

Continued

Change (%)

|

+65 (+0.3%)

|

-1033 (-5.1%)

|

+1322 (+7.0%)

|

+3815 (+24.7%)

|

Virginia Continued Weeks Claimed as a Percentage of Total Workforce

A person who has already filed an initial claim and who has experienced a week of unemployment files a continued claim to claim benefits for that week of unemployment. On a weekly basis, continued claims reflect a good approximation of the current number of insured unemployed workers filing for UI benefits, and are a good indicator of labor market conditions. While continued claims are not a leading indicator, they provide confirming evidence of the direction of the economy.

The color-coded map below shows the distribution of this week’s continued claims in Virginia’s counties and cities, expressed as a percentage of each locality’s labor force. This approach provides a more meaningful comparison across areas by adjusting for differences in labor force size. Yellow represents a lower percentage of continued claims relative to the labor force, while progressively darker shades transitioning from yellow to green and dark green indicate higher percentages. The legend at the bottom shows the color spectrum and its corresponding percentage ranges.