December 19, 2023

RICHMOND— The Department of Workforce Development and Advancement (DWDA) announced today that the U.S. Bureau of Labor Statistics’ October 2023 Job Openings and Labor Turnover Survey (JOLTS) reports a decrease in hires in the Commonwealth.

According to the most recent BLS JOLTS survey data, the number of October 2023 job quits in Virginia fell by seventeen percent compared to October 2022. Though partially recovering from July’s drop, job openings also remained over twenty percent lower than October 2022. BLS JOLTS data provides information on all the pieces that go into the net change in the number of jobs. These components include job openings, hires, layoffs, voluntary quits, and other job separations (which includes retirements and worker deaths). Putting those components together reveals the overall change in payroll employment. JOLTS data is seasonally adjusted and describes conditions on the last business day of the month. Current month’s data are preliminary and the previous month’s data have been revised.

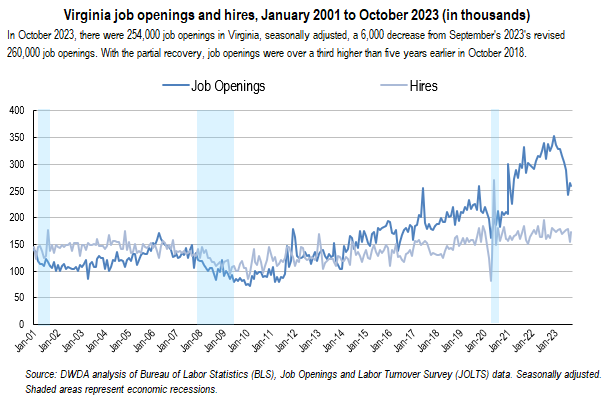

On the last business day in October, there were 254,000 job openings in Virginia, seasonally adjusted, a 6,000 decrease from September’s 2023’s revised 260,000 job openings. Nationwide, the number of job openings decreased to 8.7 million (-617,000). Over the month, U.S. job openings decreased in health care and social assistance (-236,000), finance and insurance (-168,000), and real estate and rental and leasing (-49,000). Job openings increased in information (+39,000). The largest decreases in the job openings level occurred in Tennessee (-84,000), California (-60,000), and Illinois (-49,000).

In Virginia, the October job openings rate was 5.7%, down 0.2 points from September. The U.S. job openings rate was 5.3 percent in October 2023, 0.3 percentage points lower than it was in the previous month. The rate was 2.1 percentage points lower than its peak of 7.4 percent in March 2022 and the lowest since the rate was 5.1 percent in February 2021. In October 2023, the job openings rates in professional and business services (7.1 percent) and leisure and hospitality (6.8 percent) were among the highest. In contrast, the job openings rates in state and local government (3.9 percent) and mining and logging (4.0 percent) were among the lowest. The largest decreases in job openings rates occurred in Tennessee (-2.2 percentage points), Louisiana (-1.2 points), and Wisconsin (-1.0 point). The number of hires in Virginia declined to 158,000 in October, a decrease of 15,000 over the month and by 3,000 from five years earlier in October 2018. JOLTS defines hires as all additions to the payroll during the month. The number of hires was up 77,000 from the series low of 81,000 in April 2020. Nationwide in October, the number of hires changed little at 5.9 million. The number of U.S. hires decreased in accommodation and food services (-110,000). The largest decreases in the hires level occurred in North Carolina (-29,000), Kentucky (-28,000), and Louisiana (-25,000). Large increases occurred in Texas (+86,000) and Iowa (+9,000). In Virginia, the hires rate decreased to 3.8 percent from September’s revised 4.2 percent rate. In October, the U.S. hires rate was 3.7 percent for the fourth month in a row. Among the major industries, rate changes were mixed over the year. The U.S. hires rate in Manufacturing decreased 0.5 percentage point from 3.4 percent in October 2022 to 2.9 percent in October 2023. The Arts, Entertainment, and Recreation, hires rate increased 0.7 percentage point over the year to 6.4 percent. The hires rate significantly decreased in Kentucky (-1.4 percentage points), Louisiana (-1.3 points), and Alabama (-0.7 point).

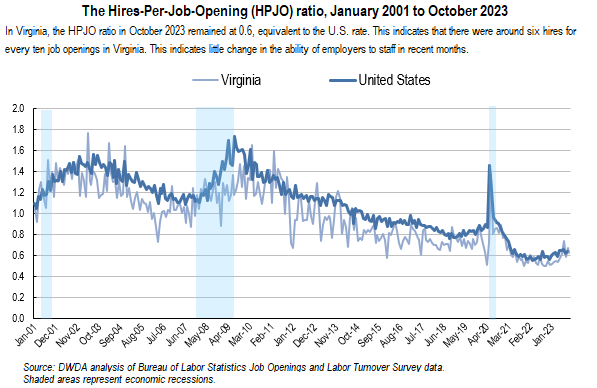

The hires-per-job-openings (HPJO) ratio was little changed in October at 62 percent and has been equivalent to the rate nationwide in recent months. This measure shows the rate of hiring compared to open jobs and is a proxy for time to fill positions. For the last two years, the rate has hovered between five and six hires for every ten job openings in the Commonwealth.

In October 2023, the Virginia ‘annual fill’ rate (the ratio of ‘this month’ hires to ’last month’ job openings, over the year) remained significantly above the historical, typical level of 1.0 to 1.27—the highest rate since early in 2021. The fill rate is a measure used to evaluate how labor markets differ in the pace that job openings are filled. An annual fill rate near or above 1.0 can indicate that employers are growing more efficient at filling job openings. On the other hand, an annual fill rate of less than 1.0 can indicate a tighter labor market, with employers having greater difficulty filling job openings compared to a year earlier. Going back to 2001, the highest annual fill rate occurred during May 2020 because, after the nationwide shutdown due to the COVID-19 pandemic, employers across the country sought to quickly hire for vacated positions. The lowest fill rate in Virginia occurred in June 2021. During that time, there were many factors that hindered the filling of vacant positions by employers, such as health concerns, employee skills, and childcare needs, but the biggest factor was the comparison against the historic re-hiring hike the year before.

On the last business day of October, the number of total separations in Virginia increased by 11,000 to 158,000. This was eight percent higher over the month. The number total separations nationwide in October changed little at 5.6 million. Over the month, the number of total separations significantly increased in professional and business services (+121,000). The largest increases in the total separations level occurred in New Jersey (+52,000), Pennsylvania (+37,000), and Massachusetts (+24,000). The Virginia total separations rate increased from 3.5 to 3.8 percent.

The U.S. total separations rate was unchanged at 3.6 percent for the fifth consecutive month. The total separations rate significantly decreased for establishments with 5,000 or more employees. Significant increases in total separations rates occurred in New Jersey (+1.2 percentage points), as well as in Massachusetts and Pennsylvania (+0.6 point each). Significant decreases occurred in Kansas and Minnesota (-0.9 point each). An estimated 102,000 workers quit jobs from Virginia employers in October. The number of quits increased by 1,000 from September’s revised figure of 101,000. That was a seventeen percent decrease over-the-year but a twenty-five percent increase from five years earlier. Quits, a component of total separations, are voluntary separations initiated by the employee. The number of quits significantly increased in professional and business services (+97,000). Slightly higher than nationwide, the quits rate in the Commonwealth fell was unchanged at 2.4 percent and remained at levels seen over the last two years. Over the month, the U.S. rate was 2.3 percent for the fourth consecutive month. The quits rate significantly decreased for establishments with 5,000 or more employees.

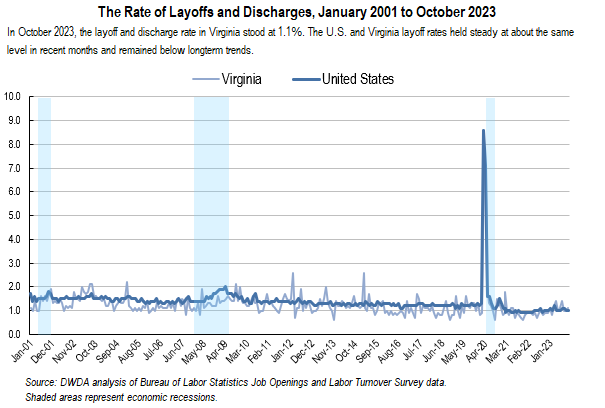

The number of layoffs and discharges in Virginia edged up to 44,000 in October. This was an increase of thirteen percent over the year, but still at low, pre-Pandemic levels. Layoffs and discharges are countercyclical, which means that layoffs typically increase during economic contractions and decrease during economic expansions. In October, the number of U.S. layoffs and discharges changed little at 1.6 million. The number of layoffs and discharges changed little in all industries. The largest increases in the layoffs and discharges level occurred in New Jersey (+51,000), Pennsylvania (+38,000), and Massachusetts (+23,000). The largest decreases occurred in Minnesota (-24,000), Missouri (-16,000), and Kansas (-9,000). The Virginia layoffs and discharges rate was little changed at 1.1 percent, while the rate of layoffs and discharges significantly increased in Maine and New Jersey (+1.1 percentage points each) and in Montana (+0.8 point). Significant decreases occurred in Minnesota (-0.8 point), as well as in Kansas and Missouri (-0.6 point each).

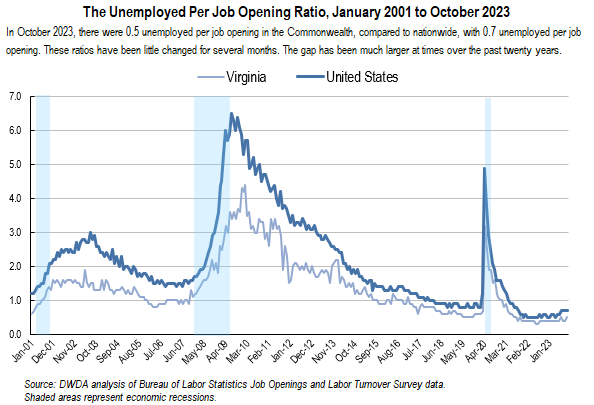

In October 2023, there was one unemployed worker for every two job openings in the Commonwealth, within the range that it has hovered around since 2021. This period marked the lowest rates since January 2001, when BLS began collecting the data. In Virginia, the unemployed per job opening ratio (sometimes called the ‘job seekers ratio’) peaked at 4.4 unemployed per job opening in February 2010 during the Great Recession. The number of unemployed workers per job opening stood at 3.2 in April 2020 during the height of pandemic employment impacts. Across the U.S., there was a ratio of unemployed people to job openings of 0.7 in October, unchanged over the month. The ratio of unemployed people per job opening has been below 1.0 since July 2021. The number of unemployed people per job opening nationwide reached its highest level of 6.5 in July of 2009, at the height of the Great Recession.

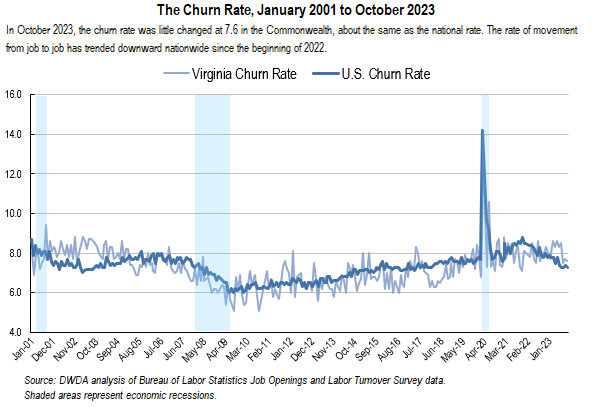

The October 2023 churn rate (the sum of the hires rate and the total separations rate) slowed slightly to 7.6 from September’s revised 7.7 rate in Virginia yet indicating still-elevated velocity of rotation into and out of jobs. Nationwide’s churn rate was 7.3, which was little changed over the month but a 0.5-point deceleration over the year. An elevated churn rate indicates a labor market with a high hires rate, a high separations rate, or both. It can signify that workers are moving more frequently into and out of jobs in the labor market. Conversely, a low churn rate indicates a labor market with a low hires rate, a low separations rate, or both.

Virginia JOLTS data for October indicate that hiring and quitting were a little slower than was typical for 2023. However, job markets remained strong overall with elevated levels of job openings, though they too have trended downward in the Commonwealth and nationwide since their peak nearly two years ago. The U.S. job openings rate was 5.3 percent in October 2023, 0.3 percentage point lower than it was in the previous month and the lowest since the rate was 5.1 percent in February 2021. As has often been the case, job openings around the country, in part, reflected increased hires and quits. As this job churn has slowly declined, so have job openings. This effect has been more subtle in Virginia than nationwide in 2023. The ability of employers to fill positions compared to the previous year reached its most elevated level since early 2021.

Definitions of JOLTS terms*

Job Openings

Job openings include all positions that are open on the last business day of the reference month. A job is open only if it meets the following three conditions: (1) A specific position exists and there is work available for that position; the position can be full time or part time, and it can be permanent, short term, or seasonal; (2) the job could start within 30 days, whether or not the employer can find a suitable candidate during that time; and (3) the employer is actively recruiting workers from outside the establishment to fill the position. Excluded are positions open only to internal transfers, promotions or demotions, or recalls from layoffs.

Hires

Hires include all additions to the payroll during the entire reference month, including newly hired and rehired employees; full-time and part-time employees; permanent, short-term, and seasonal employees; employees who were recalled to a job at the location following a layoff (formal suspension from pay status) lasting more than 7 days; on-call or intermittent employees who returned to work after having been formally separated; workers who were hired and separated during the month; and transfers from other locations. Excluded are transfers or promotions within the reporting location, employees returning from a strike, and employees of temporary help agencies, employee leasing companies, outside contractors, or consultants.

Separations

Separations include all separations from the payroll during the entire reference month and are reported by type of separation: quits, layoffs and discharges, and other separations. Quits include employees who left voluntarily, except for retirements or transfers to other locations. Layoffs and discharges include involuntary separations initiated by the employer, including layoffs with no intent to rehire; layoffs (formal suspensions from pay status) lasting or expected to last more than 7 days; discharges resulting from mergers, downsizing, or closings; firings or other discharges for cause; terminations of permanent or short-term employees; and terminations of seasonal employees (whether or not they are expected to return the next season). Other separations include retirements, transfers to other locations, separations due to employee disability, and deaths. Excluded are transfers within the same location, employees on strike, and employees of temporary help agencies, employee leasing companies, outside contractors, or consultants.

*Excerpted from U.S. Bureau of Labor Statistics, Handbook of Methods, Job Openings and Labor Turnover Survey: Concepts, https://www.bls.gov/opub/hom/jlt/concepts.htm.

The Department of Workforce Development and Advancement (DWDA) plans to release the November 2023 analysis of the BLS Job Openings and Labor Turnover Survey for Virginia on Monday, January 22, 2023. The data for all states and the U.S. will be available on the BLS website JOLTS page, at https://www.bls.gov/jlt/. BLS is scheduled to release the October JOLTS data for states on Thursday, January 18, 2023.

Technical note: The Bureau of Labor Statistics (BLS) Job Openings and Labor Turnover Survey (JOLTS) produces monthly data on U.S. and regional job openings, hires, quits, layoffs and discharges, and other separations from a sample of approximately 21,000 establishments. As a supplement, BLS has begun publishing state estimates that provide monthly information that can be used to better understand the dynamic activity of businesses in state economies that leads to aggregate employment changes. For more information on the program’s concepts and methodology, see “Job Openings and Labor Turnover Survey: Handbook of Methods” (Washington, DC: U.S. Bureau of Labor Statistics, July 13, 2020), https://www.bls.gov/opub/hom/jlt/home.htm. For more information on BLS’ state JOLTS estimates, see https://www.bls.gov/jlt/jlt_statedata.htm.

PDF of Press Release

PDF of Press Release